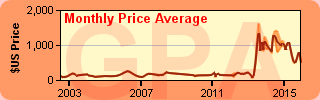

If you troll the auction sites as much as I do then you’ve noticed something interesting lately. It’s hard to account for every book but many of our favourite keys seem to be levelling out and some even trending downward. The value of books like New Mutants #98, Batman Adventures #12 and even the mighty bellwether, the Hulk #181 at most grades are lower now than they were a few months ago. As well, online sales during this holiday season was, for me personally and for others I’ve spoken to, unusually flat. But before we declare that the sky is falling, let’s think about this in-depth first…

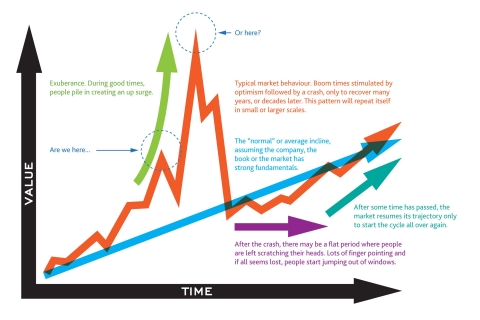

Historically, much like the stock market, comics have always risen in value. Sometimes certain books would spike or drop but overall the trend was a steady rise. Most notably, the market dropped in the 1990’s and levelled out. During the period of the US housing crisis, the market responded to the economy and liquidity was a problem. The only way you could sell a big book was to drastically discount it, which caused many titles to trend downward. Surprisingly however, the market came roaring back. As the economy improved, comics have been on a tear since. Books like Amazing Fantasy #15 and Hulk #1 in particular have seen tremendous gains, especially in the more affordable mid to lower grades.

I spoke often about the huge bulge of baby boomers ahead of us and how movies have afforded us another opportunity to liquidate our collections. We also know that Hollywood has planned films in the pipe up to 2020 and beyond. As such, the strength of “key” issues have never been stronger since the 1980’s. Some people I’ve spoken with feel that the party can and will go on all night, but I’m of the camp that all things come to an eventual end. So the question on my mind is, is this the beginning of the end? No one can answer this of course, and any attempt would be a wild guess. Being in the moment means that we’re to close to see the big picture.

When it comes to the stock market, a particular stock, or the market as a whole can suddenly shift and climb. The slope changes and can become near vertical as more people pile in due to positive sentiment. Millionaires are made during this period but eventually things do slow down, or worse… it crashes. The people who get out in time get to keep their money while the rest get slaughtered like pigs. Such was the case for companies like Qualcomm during the tech bubble of the late 1990’s. However, if the company has good fundamentals, it will bounce back from the crash and resume climbing from their new low. It took years but eventually Qualcomm and other good companies have recouped their losses and even surpassed their previous highs. But no one can predict any of this. Many companies go belly up, become delisted or get bought out. Companies like Research in Motion (renamed Blackberry) and Nortel were the darlings of the Canadian economy who have now become case studies for business scholars. If any of this sounds familiar, it’s because the comic market has followed this same pattern. The comic market seems to be in the midst of another correction… but hopefully just a minor one. Perhaps the market is taking a breather after the unusually steep climb we just had. If this was the 1980’s, the current momentum could be considered business as usual but back issues have been flat since the big crash so when it comes to recent history, the current optimism is… out of sorts. We can point to movies, pent-up demand, new young readers… and of course, the ever present “band wagon” as being the stimulus, because if everyone is doing it, it must be good. I can’t tell you how many times I’ve heard statements such as “I think Star Wars #1 can still double” or “I think Doomsday can be the next Deadpool.” Believe it or not, these are actual comments that people have said to me and when questioned “why”, the typical response is that they just have a “feeling”. Sure Doomsday is credited for killing Superman and is about to be featured in an upcoming film but beyond that, where is the mass affection that Deadpool enjoys in order to keep this book from the 1990’s propped up?

We are still a ways off before older collectors start to retire and cash out in a meaningful way. Many diehards will probably continue to collect well into their retirement because life long habits are hard to break. However, I do believe that many collectors have all the books they need so the majority of the people engaged in the buying and selling of books are speculators like myself. I’ve personally spoken to many collectors who have several hundred long boxes in their basement and are trying to pare down the bulk of their inventory in order to focus on more manageable keys. As well, what will be the mindset of buyers who continually get burned? The people who repeatedly purchase books during the peak of any given hype, only to have the value of their purchase take a dive after the hype has died down. I mean… the money has to come from somewhere, and is anyone interested in the first appearance of Ultron anymore? How do you get rid of these books without taking a haircut? Can these books climb back up like Qualcomm… and if so, practically speaking, are these buyers willing to wait several years or a decade just to break even? Unfortunately, the comic market has no quantifiable data but clearly the negative factors that can cause a retraction is in place.

People like to point to film as the main reason for this recent comic boom but after a decade of top notch movies, do the forthcoming Avengers films have the same cachet these days as the first? Back then, it was joy to see all our heroes in the same picture but with recent movies like Jurassic World, Star Wars and the imminent sequel to Avatar… Avengers is now becoming more of a reason for the individual movies to take place as we eagerly wait for films like Doctor Strange, Black Panther and Captain Marvel. Don’t get me wrong… I enjoyed both Avengers films but how many more movies can they make where a meaningless army goes up against our beloved heroes so that the film can feature each character in action? Perhaps with enough time in-between, each movie can appear fresh. We’ll just have to wait and see.

I make no predictions other than that Doomsday will NOT be the next Deadpool. I’m no better at predicting the future than the next person but the facts are there for you to interpret any way you’d like. I think we can safely declare that the sky is not falling and that current retraction is probably, hopefully, maybe… just a bump in road, but be mindful of the fact that the highs are behind us for now. With change also comes opportunity so have fun collecting, buying and selling… but just don’t get caught with the next Avengers #55 once the hype has died down.

Great article Charlie well researched. It highlights the “lemming”-like behavior of humans in markets. As with all markets Stocks, Bonds, Fine Art, Comics etc people enter the market when its rising and just chase the hot stuff without paying the “school-fees”. What I mean by that they have not bought and sold items and experienced what works and what doesn’t. When you’ve experienced wins and losses you learn a lot mainly from your losses.

Right now the Great Marvel Gold Rush continues but meantime over in the Golden Age, Matt Baker arena, and many other pockets there remain undervalued books beginning to get the attention they have been lacking and deserve.

Comics is a big and broad market some parts could drop but some will go up as well. For those willing to spend time on some research before buying they will do ok I believe. For the Lemmings the time old saying is still fresh “Caveat Emptor” (Buyer Beware)

Thanks David.

“Experience is a brutal teacher, but you learn. By God how you learn.”

I can’t remember the name of movie that the quote came from but it stared Anthony Hopkins.

We just have remind ourselves that the only reason any of this stuff is worth money is because some one is willing to pay for it. As soon as the buyers are gone or lose interest, it’s just all ink on paper. Big books like Act#1 or Det#27 do have historical value, but all that keeps books like Hulk#181 in the collector mindset is the simple desire to own one on mass scale.

Do you remember how huge a movie T2 was? Well, I know many teenagers who have never seen it, and don’t really know anything about it, except perhaps a vague, general idea that the Terminator is a movie and a character with a franchise. So I pin nearly ZERO importance on movies in influencing a comic book’s long-term value. In comics, the weight of history means everything. Maybe it’s largely because of the aging population of collectors. I almost laughed at some of the comments on Walt’s recent undervalued spotlight: for example, “without Gwen Stacy there’d be no Spider-Gwen” etc., — as if that character weren’t already supremely important in the Spider-Man mythos for DECADES before those terrible movies with Emma Stone, and way before whatever current stupid incarnation Marvel has cooked up to rehash, redo, revamp, or clone one of its old ideas. The “no longer dead” Norman Osborn may be a gigantic player in 21st-century Marvel comics, but the value of his (and the Goblin’s) 1st appearances are always going to depend mostly on the fact that he was Spidey’s main villain in the ’60s and ’70s, the seminal era for the character and the whole fictional universe he inhabits. Does anyone cite the Onslaught storyline as a factor in the current value of Professor X’s early appearances? No. Big storyline, but basically irrelevant in the grand scheme, as he was a foundational character since X-Men #1. Movies and current comics may provide a blip that collectors and speculators can exploit (or fall prey to), but that’s about it.

Thor Odinson, well put… and I tend to agree. Collectors like to try and explain away the recent surge in key comics, pointing to Hollywood as the trigger. However, superhero movies have always been around. True the current movies are more sophisticated but the question remains… why now? It’s no different in economics, politics or even Hollywood itself. People like to present themselves as an expert or having knowledge but in truth, I don’t think anyone really knows. My explanation on the recent strength of the US dollar is just as good as any economist. It’s all just an interpretation of current events.

The other point is, just because people enjoy the movies does not make them an instant comic fan, any more than a movie about rock climbing is going to make me go out and buy some rope. My kids are old enough to enjoy past TV shows like the Justice League and they’ve become very familiar with characters like Hawkgirl and the Martian Manhunter. However, despite my encouragement, they have ZERO interest in comics beyond the fact that their father is a geek. As you say, history plays an important part and so younger collectors will have less or no connection with the past that we are familiar with, So in other words, Man of Steel #18 was one of those 90’s junk books and it probably still is.

Fantastic post Charlie.

I’d like to add a thought regarding the softness of the general market, I won’t speak of individual books like Avengers #55, stuff like that will always happen.

Consider as a contributing factor (not the only one) what has been happening in the world currency values over the last 15 months. Consider the fact that more and more American Comic Book pop culture was being purchased by overseas money, including Canadian. Consider collectors and investors buying patterns over the past decade, a decade that saw buying power slowly increase in these non USA markets thanks to their home currency’s value relative the USD$.

Ask yourself as a Canadian how much you feel like paying a 45% premium on a book you were buying at par 3 years ago. Same goes for people holding Euros, Yuans, Pounds etc. All these currencies have lost a lot of ground to the USD over the last little while and it has taken the wind out of non US buyers.

I’m positive Canadians, Germans, Chinese still want that Hulk #181 real bad but they just can’t get past the exchange. This may be enough to stall the general upward trend we were seeing.

I think there is still a ton of foreign money just itching to buy up all those great comics, the demand is still there and now its starting to get pent up.

Thanks Walter. The current exchange does not deter me much because I roll the same money back into books. Also, I get the occasional sale from overseas but not enough for it to be very meaningful. The bulk of buying and selling happens in the US and that’s what I count on. Still, not everyone thinks the way I do and perception does matter so you could be right… In which case, the reverse would also have to be true and the recent speculative boom could have been triggered by the previously weak US dollar and not so much Hollywood. Perhaps the Chinese people saw this as a buying opportunity and started picking up Hulk#181’s creating another speculative market. But then why comics? Why don’t we see this happening in other investment areas? Like I say above, we all have our own interpretation of why things are the way they are so your guess is just as good as mine.

Regarding Av#55… my apologies to anyone who owns one of these. I own a mid grade copy myself and I don’t mean to pick on this one particular book but it goes back to my previous post about buying quality keys… but, YES! Stuff like this does happen all the time. This is exactly my point. I’m trying to shed light on a pattern that many people still don’t seem to recognize… and I think this hurts the market far more than you may realize. For people who’s hope of appreciation is let down, they will give up get out all together, which is basically what happened during the 1990’s. I think we would have a much more stable market if people focused on quality over hype.

I think you’re right and the engine will start to roll again but I see it more as a result of human nature.

I’m certain weak non US currencies are affecting buying patterns, though I have no idea by how much and you may be right that it is minimal. I’ve talked to guys with books in Canada and many still active participants have opted to “cash out” a certain portion of their collection to reap the exchange. So this adds more supply to an already softening demand.

I think we’ve seen this many times before Charlie. I remember when the Yen was strong way back when and the Japanese were going on a US real estate buying spree. Generally when the American dollar is weak we see an increased activity in the rest of the world snapping up US real estate, US companies, US collectibles. Thus it stands to reason that this activity decreases when the US dollar is strong.

The currency angle is just one I’m adding in to consider. The extent of the effect on the market may be negligible but believe there is an effect.

I don’t see how “minimal” and “negligible” factors can have such a mass effect. Smart people understand that the premium you mention is just an illusion because if you buy US, the money is still there, tied up… in US. But I understand that people may perceive it as a “premium” so yes, this perception can definitely have an effect.

Regarding the Japanese Yen… If the Japanese actually owned a lot of American real estate, they would have been better off. The problem was, it was all leveraged. The government allowed their currency to get over inflated to the point where it was ridiculously overvalued. Once their market crashed, they couldn’t pay their bills and they’ve never been able to recover since. Lifelong savings vanished. China is having a similar problem right now… and I’m sure we’ll be hearing about Greece again soon enough. We’ll have to see how it all plays out. In general, everybody wants to buy American anyways because the USD is considered the most stable in the world… The new Toronto subway extension was funded buy a Chinese tycoon so that he could build properties at each stop… and this was when the CAD was strong.

Oversea buyers tend to be US expats or people who’ve lived in North American as a child and returned back to their homeland. Honestly, if I was Chinese with a bit of extra cash looking to invest, I wouldn’t be buying Hulk#181’s. Having lived in Hong Kong for 7 years, American comics are not as popular as you may think over there. The Japanese pop culture has a much greater influence. The average Hong Kong citizen don’t even know who Wolverine is and Hong Kong is more westernize than the rest of China. Comic buyers have a personal connection with books… Its as much about emotion as it is investing. Without that emotional component… I just can’t see it.

In any case, I”m sure there are many reason as to why things are the way they are but it doesn’t change the current slump that we are experiencing. But I do agree that things will improve. I’ll try and work on a more positive write up which I think you’ll be more happier with.

For what it’ worth, I’d like to offer some anecdotal evidence to support Charlie’s claim that outside of North America ‘American comics are not as popular as you may think’.

I live in Japan and have a moderate collection of silver and bronze age comics, mainly Marvel with some keys in reasonable shape, that I’m looking to sell.

I thought that there might be some interested collectors in Japan. I mean Japan’s a big place right? They’ve got fanatics for everything right? They like American pop culture right? But I did a lot of searching on line for shops or blogs about collecting older American comics and found nothing. I could only search in English, so I though that might be limiting the results. I decided I’d check out the one shop in Tokyo that looked like it dealt in older American comics. The owner (maybe mid-30’s) had spent some time in LA and had a dozen or so long boxes with a weak collection of Marvel and DC comics, some from the 70’s but most were more recent. No new comics. I asked him if there was any demand. He shook his head. None. He didn’t bother selling boards or bags. He said people don’t care about American comics. They’ve got their own deep manga industry. They certainly weren’t interested in spending money on back issues. He mainly sold t-shirts and action figures, little of it associated with American superheroes. Ok, this guy wasn’t much of a dealer and I have to say his business model didn’t look very sound, but he was the only one I could find. I’m sure there are Japanese collectors of American comics out there somewhere, but it’s a small, and practically invisible community. I’ve given up on the idea of selling anything here.

I also lived in Rome for a while, and although I didn’t really do a lot of research, my impression from online searches was that there wasn’t much of a collector community for American comics there either. The Europeans also have their own comic book traditions.

Comic collectors and speculators all start out with some honest affection for comics. I can’t imagine doing the research needed to make good comic book investments unless you take some sort of pleasure in comic book history, and this pleasure is usually tied up with the fact that comic book history makes up a large part your personal history. Nostalgia will always be the central factor in maintaining interest and demand.

The international success of superhero films won’t fuel demand for American comics in countries where people have no nostalgia for the comic book heroes that inspired the films. Like Walter I wanted to believe that there’s a lot of ‘foreign money itching to buy all those great comics’. But I have reluctantly come to the conclusion that interest for comics (Marvel, DC etc) will always be mainly limited to North America (maybe the England and Australia?) and expats. The only exception might be super wealthy international buyers that can purchase an ultra-expensive book as a trophy.

By the way, this is the first comment I’ve ever made on any web site, which is a testament to how much I enjoy coming here.

I’m glad we flushed you out Gordon you’ve offered some great insights and personal observations.

To defend my position a bit I never meant nostalgia driven comic collecting. I’ve always meant the higher end investment market.

I remember years ago when I sold on eBay I’d get German buyers for some of the bigger books, though I did not follow up enough to see if these were ex-pat buyers.

I’ll still hold that there is a market effect here but am noting others opinions that I have overstated it.

Reed enterprises which run the New York Comic Con ( 2nd largest Con in America) recently started having them in Paris and London and have signed a deal in China. I would think that speaks better of their interest in our heroes than what you have alluded to.

Thanks for sharing Gordon. My experience overseas has been similar to yours where comics are concerned.

I think the other way we can look at this is… why aren’t any of us invested Chinese Jade, Korean Ginseng roots, Stradivarius violins or Parisian wine?

Yes, there’s money to be made in these markets… but, heck… why would we invest in this stuff?

What about more local items… coins, stamps, emeralds, gold, bank notes, antiques…?

The answer, of course is that we have no connection to these other items.

Interestingly, there are more millionaires per capita in Hong Kong than anywhere else. So if you have cash to burn, are these guys seriously going to buy a HulK#181? I bought my CGC 9.0 for about $1200 a couple years ago… today, a 9.0 is worth about $2700. A potential profit of $1500. What does $1500 mean to a millionaire? It’s a drop in the bucket. Let’s say the buyer is not a millionaire… he’s like me, unemployed, poor with 3 kids. Why would some guy from China drop $1200, hoping to turn it into $1500 down the road… unless, he’s like me and grew up with this stuff and wants to play the game.

Let’s forget about overseas… let’s talk local. Why isn’t my neighbour or all the people in the next apartment building investing in comics? They go see all the movies so they must have some interest right? Maybe a few of them do buy the occasional comic, and fewer still would consider comics as an investment. The rest enjoy being entertained by movies, but have ZERO connection with the actual books themselves, and definitely not as an investment. So if most of the local people have not interest, why would the Chinese?

But lets say Walter is right. A large flow of foreign money triggers another spec boom. Now, this same money dissipates and softens the market. So this American product, with the bulk collectors situated in the US are dependant on foreign investors? So all the collectors in the US can’t keep the market going without the handful of Chinese, German and Indonesian collectors? Isn’t this a more frightening thought, to think that hordes of American collectors isn’t able to sustain their own pop culture market. After all, they have the numbers…

You have to keep in mind that comics is just a hobby. It’s not high finance, it’s not art and it doesn’t have the mass appeal or understanding like jewels or real estate. Compared to music, sports or dance, it’s relatively a small market. But, we can own it and I don’t think it has to be any of this other stuff in order to enjoy it.

– – – – – – – – – – – – – –

Jeff, considering that most comic cons are actually not “comic” cons anymore, I’d really like to see how their effort in China pans out. I think that we’re all in agreement that the local FanExpo is a toy show or a media show. So if a comic book only show can’t be sustain here Toronto, what chance does it have in China? If it happens, it’s more likely an opportunity to expand the brand and they’ll probably customize it to local tastes. I imagine they’ll have lots of toys, manga and other Chinese related products.

There is a silver lining to all this which I’ll discuss in another write up.

I also saw a relative lack of interest in Europe last year with very little American comics back issues and a distinct dislike of slabbed books in general.I liquidated some of my major keys and took advantage of the dollar exchange and got a great return on my initial investment. I find it is again a pretty good time to pick up these major keys again although at a higher cost than originally.

The window on the “hot ” book of the day like the Avengers #55(again, just an example, not to pick on this book) can be quite small and it can be easy to buy high and sell low, which as someone who has been around the comic collecting block for a while , try to avoid but still can get caught.I find that if I stay within the confines of what I personally like and therefore know, I do pretty good because of that nostalgic connection.The low Canadian dollar is a challenge but fortunately most of my sales are in the US or in US funds therefore the exchange rate has a tendency to come out in the wash.. One noticeable exception to the European market for me has been Britain.I have sold a fair number of key books into the UK.. Great post Charlie and also great comments from all!

Great to hear from you Dennis! What are you up to these days? You and Ed seem to have conspicuously moved on without much fanfare.

I suspect foreigners would be interested in ‘American comics just as much as Americans would be interested in foreign comics. I know that manga is big, but only because it’s been translated, and not as an investment.

Well Charlie, Tales from the Comicdenn returns this week! I have been busy working on my Graphic Novel “Splashdown”.100 page story, which is fully pencilled and 2/3rds inked now.I will be doing some shameless self promoting moving forward.

I plan on being back on a regular basis, hopefully every 2 weeks.

All the best!

interesting post, but has some flaws:

1. first and foremost, all your price charts are not relevant. simple arithmetic charts of the data won’t compare previous advances and corrections properly. get log charts. then post those. while you’re at it, adjust for a canadian investor in those comics to take into account currency fluctuations.

2. comics are not stocks.. the comparison is not valid.

3. “Historically, much like the stock market, comics have always risen in value. ”

not a valid statement. stocks do not always rise. you don’t have the relevant data to comment on comic values. only on certain books. compile a price chart going back to the 1970’s, then present the findings.

4.. “We are still a ways off before older collectors start to retire and cash out in a meaningful way. ”

that’s the wrong question. the right question is : “are there enough NEW collectors to absorb the selling from older collectors” . again, you don’t have the relevant data.

5. “the only reason any of this stuff is worth money is because some one is willing to pay for it. ”

again, not a relevant point. that’s with everything. wine, art, real estate, computer.

6. “Collectors like to try and explain away the recent surge in key comics, pointing to Hollywood as the trigger. However, superhero movies have always been around.”

what hasn’t been around forever is 3rd party grading, ebay and other auction sites. you’ve failed to take this into account in your post.

7. “The current exchange does not deter me much because I roll the same money back into books.”

maybe YOU do, but the average collector does NOT hold USD accounts waiting to purchase comics. and who held USD while it was collapsing for more than a decade? nope. the USD strength plays a MAJOUR roll in foreign comic purchases.

8. “I don’t see how “minimal” and “negligible” factors can have such a mass effect. ”

prices are always affected at the margin. it’s always the last price that matters.

9. “In general, everybody wants to buy American anyways because the USD is considered the most stable in the world… ”

not true.. the USD is the most LIQUID currency in the world. the SWISS FRANC is the most STABLE. investors know this.

10. “I think the other way we can look at this is… why aren’t any of us invested Chinese Jade, Korean Ginseng roots, Stradivarius violins or Parisian wine? ”

you probably don’t have the money to buy a Stradivarius. LCBO has been offering wine futures for years now to clients willing to buy. just because you don’t have an interest, doesn’t mean others don’t

Wow… that’s pretty impressive Dennis. I really admire people who can follow through with their personal projects. Please save the first copy for me. I can’t wait to read it ^_^

Richard, if you read through my write up and the comments more carefully, I think you’ll realize that all you’re points have already been addressed… and the few that haven’t been have no relevance. For example, I freely admit that I can’t afford a Stradivarius but my financial circumstance has no bearing on the discussion. In any case, thanks for taking the time to comment.

hey. no worries. it’s easy to find a few books to prove your point. books that have spiked up with massive price gains, and are now settling back down. but that’s what happens when one comes to the conclusion first, then writes a story to prove himself right.

i’m sure it’s easy enough to put up hundreds that are still rising and aren’t seeing any selling pressure at all. but you didn’t list those, did you…..

Richard, I have nothing to gain from whether people believe me or not. I’m pointing out something I’ve observed in an attempt to try and inform people. The stats are out there for anyone to access. I clearly state that I’m no better at predicting the future then you are so if you choose to connect the dots differently, that’s your prerogative. I hope you and your “hundreds” of rising books do well.

Amazing Spider-Man 50

Amazing Spider-man 129

Strange Adventures 205

Flash 105

Flash 110

Flash 139

Action 242

Action 252

House of Secrets 92

All Star Comics 58

Strange Tales 110

Werewolf by Night 32

the list goes on and on and on….

Furthermore, the “canary in the coal mine”, Hulk #181, has suffered a “price drop” in the 9.0 grade. there is NO corresponding price drop in the grades around that. not in the 9.4, 9.2, 8.5, 8.0 and 7.5 grades. these have not suffered any significant price drops, and are trending HIGHER.

pick the one grade that proves your point.

looking even deeper into the sales data for 9.0’s, there, there was ONE!! transaction at $3800. ONE!! this was the sole cause of the apparent “collapse”

Yup… sure. That’s great Robert. What ever you say. Thanks for all your comments.

Well Charlie you know Hulk 181 and Spider-Man is all there ever was, is, and will be in the riches of our field……but of course!

Richard out of your above list 3 or 4 will grow nicely. The rest i have some very strong reservations about. Have a nice day one and all!

stephen, those are just examples to counter Charlie’s argument that the sky is falling. all the ones i listed have seen price appreciations without any corrections (yet). yes, some will peak at a point, and stagnate/decline, some will not. it wasn’t meant to be a list of investment comics.

i think it’s simply disingenuous for someone to put up a handful of books, (two of which are modern), that show recent price declines, after a long period of gains, and claims the industry is in trouble.

NM98 and BA12, i wouldn’t even consider part of the discussion. i’ve already discussed hulk 181 and the one false data point, that leaves us with 3? books that have dropped? Ultron, Ms. Marvel and star wars? the health of the comic industry and comic collecting rests on Ms. Marvel and Ultron?

please. give me a break.

I have to say Stephen, I’m torn about the US elections. I like Rubio but I actually would like to see Trump lead the Republican’s. I also like Hilary. The Clinton years were good times. Despite the scandals, Clinton left the office with a huge surplus. How amazing was that…!?! And any successful marriage is a marriage of like minds.

But, was Clinton really any good? Or was he simply the recipient of the new economy? i.e.; the internet boom. Prior to Clinton, the US was in really bad shape. Having moved all your factories over seas, the US was a country of “sales” people with nothing to sell (aside from Hollywood and sports which is not enough). The rise of the internet coincided with Clinton’s time in office so maybe it was just a matter of being at the right place at the right time, as most successes are. Still, it would be nice to have a woman in office… finally (no, NOT Carly Fiorina)

But Trump is not like any of these people. He is the Ross Perot that we never had. I think it could be really, really good… or really, really bad. Either way, I like to see things stirred up as opposed to the same old, same old.

What does this have to do with comics…? Economy good, comic market good. Economy bad, comic market bad. I guess we’ll see what happens…

Charlie, Bernie + Elizabeth Worden (spelling?) . Or Donald and Worden ? I do not trust the Clintons , or Dems or Repubs as a Disabled Draftee Vietnam Combat Vet!! And i will never accept Block Granting . Just keep the VA Federal and root out any Fraud, Waste and Abuse! e are not Charity Cases!! There was a Contract Made to us , and Viet Vets have suffered because of Apathy, Excessive Greed and Political Rhetoric!! And after 5o years of this will any of these Candidates actually deal with ou r Security issues, as Senator Bob Dole began to address back in the 90s concerning “quality of life issues” Like proper transportation for those of us with PTSD cognitive disorder. Ok comics;—- Will Wolverine even be barely a fleeting memory 5 or 1o years from now!?! Outside the comic collector world, when hollywood loses its love affair , and the rest of the world moves on?? No real solid long term record yet Much to early!!

I hear you Stephen. Broken promises from politicians is a huge cliche. But, without getting too deep, I’m convinced that it’s the system that needs an overhaul. What chance do good intentions have when small minds with a lack of vision is allowed to derail an initiative with legalities. I used to think there just wasn’t enough money to go around, but actually there is. It’s simply a question of will and as you say, greed. But Trump does have a record of getting things done. I’d like to see how the business mind would perform in the political arena.

I think comic characters will hold up long term. After all, this is what Disney and Warner bought into… The licensing is worth so much more than the publishing business. Where print continues to fade, merchandising, entertainment, sports, retail all rely on recognizable assets. People don’t know what “quality” is but they do know the Coke logo well. Slap recognizable images everywhere and… viola! Instant value transference. This in a nutshell is advertising.

As a long time collector, dealer, investor, and comic lover, I want to give my 2 cents.

I believe there is some validity to baby boomers looking to cash out their personal collections. Even big time dealers like Doug Schmell and Greg Reece ( just to name a couple) have recently sold their own personal collections for one reason or another. I don’t necessarily find this to be troublesome for the market because it happens to almost every collection at some point. Every decade has always seen life long collectors cashing out because of age, interest, financial matters, etc. However, to think that losing baby boomers alone will end the vintage/high end comic market is not true. Collectors are seemingly being rolled off of a production line wanting this stuff. My daughter is 16 and has now started to appreciate old books, and I mean 1940’s Captain America and 60’s Tales of Suspense. And she’s not alone, I see lot’s of kids and 20-30 somethings that are very much interested in these old gems. I don’t feel I’ll ever see it’s demise in my lifetime. Perhaps they have out priced themselves to many people, but they are still highly coveted.

I find too many people are using the GPA trends as the gospel valuation tool, and they should not speculate while using this site alone. In fact I’ve been guilty myself. I see a book I’m interested in (GPA trending) at say $1300 and I get one on ebay for $1100 so I can flip it, Then they all start selling for $1100 because they saw the last reported sale, MINE! And I’m stuck with it. Heritage, stores, conventions, and most transactions are not reported to GPA so we only get to see a small percentage of that selling trend, yet many of us rely on it to validate it’s value.

I often times see raw books sell on ebay for more than GPA’s reported figures.

I do believe that cons are much less about comics and all about the broad culture surrounding them. Most of the recent events I’ve attended have been comprised of about 20% comics and 80% everything else. Cosplayers are out of hand, I can’t seem to shop without being hit by a wing or sword. I’m not complaining because it is still good fun, but the foundation of cons are not about comic books,

In terms of why I (and many others) spend money of comics for investment reasons is because they are dear to our hearts and have staying power. I still thoroughly enjoy the art, stories, colors, pulp smell and nostalgic memories they bring back, I can’t get excited about pork bellies, stocks, or even most real estate.

The post that wouldn’t die!

Good points Charlie !

” In terms of why I (and many others) spend money of comics for investment reasons is because they are dear to our hearts and have staying power. I still thoroughly enjoy the art, stories, colors, pulp smell and nostalgic memories they bring back, I can’t get excited about pork bellies, stocks, or even most real estate.”

Well said Jeff.

I think Doug Schmell probably regrets his state of panic moment. Although he got good money for his collection, the sudden run up began after he dumped his books. Imagine what he could have gotten today…

Jeff, while the market will always ebb and flow with people coming and going, if you understand what the baby boomers are about, then you understand that they are massive influential consumer force. “Baby boomers” is not just another label like “Generation X”. Large conglomerates are buying up funeral homes in the US, big pharma is focusing on medication for the elderly and our own government have adjusted the immigration policy to let more people into the country. Why? Because birth rate has been on a steady decline for decades and the generation behind tends to supports the generation in front by way of taxes. With baby boomers beginning to retire and birth rate down, how else can the government get more tax payers to help support pension plans? I’m convinced that this is one of the reasons why housing continues to be so strong.

I just finished Teachers college and I was exposed to over 500 students at 4 different schools in Ontario. During my 3 stints at practice teaching, I would always unofficially poll how many of students were interested in comics. Out of the 500 students, ZERO read comics. 3 borrowed manga from the library, which was stocked with graphic novels and other comic material. Speaking with the librarian, she said that the teachers read the graphic novels more than the students. I met 12 teacher who in fact read graphic novels. All guys, all my age. So, while I think it’s great that your daughter has developed an interest in comics, I’m inclined to believe that she’s the exception. Also…

• Decline in readership

• Delcine in birth rate

• Higher cost of paper

• Higher cost of print

• Higher cost of comics… just under $5 each after taxes

• Toys, iPads, Netflix, iTunes, video games, video on demand and other distractions

• Digital downloads = free

• Marvel/DC caters to older audiences

• Trades and other reprints

• Over production (as Marvel and DC desperately try to make their numbers)

• Gimmicks such as death issues, reboots and 3D covers

• More reboots

I agree that GPA is not a complete representation of the market but when it comes to quantifiable data, it’s pretty much all we have. It’s something I can point to as opposed to saying, “I saw or I think or I believe or I have a feeling” which is purely anecdotal. I also troll the auction sites, I set up at local shows, and chat with as many people as I can. I also stick my head out from time to time in order to get a sense of what non-comic people think and feel about this stuff. Cumulatively, it does paint a picture.

Yes… comics are “dear to our hearts”, which is why I have a hard time believing that the Chinese or Germans are buying up this stuff… aside from a handful of expats. Without this emotional connection, why would some guy in Beijing want a Hulk#181 any more than we would want… as you say “Pork Bellies” or Jade jewellery? Exactly my point.

Let me be clear:

No one is saying this stuff will disappear. Words like “crash” sound exciting but in reality, it will simply be a slow and steady decline. Having said that, anything can happen. The factors that influence a market can change. AND, there are still many years ahead of us. We can talk till we’re blue in the face, citing personal experiences, but I encourage everyone to look at quantifiable global trends and project or forecast those trends, 10, 20, 30 years from now. None of us want this stuff to go away but being delusional like Robert does not help you in any way. No one is saying to stop enjoying comics. By all means, revel in it.

the only one who’s delusional is the gypsy who thinks he knows what’s going to happen 30 years from now in the comic world..

Robert (has been posting as Richard…)

yes… busy on the phone trading gold futures….. (not pork bellies)

with no way to correct the error.

Richard/Robert, I realise you’re a “special” person but you may want to take your time when reading so that you can better understand what’s been stated beyond sounding out the letters. This way, you won’t have to fabricate what you think you’ve read.

Doesn’t seem that complicated: is your name Richard or Robert?

Hey… why adjust my last comment? Ryan, Curious… now Robert. Can’t hide that convoluted logic.

Richard. please feel free to correct the error.

you must have many admirers Charles. seems you keep writing about the end of the comic industry….

as i’ve stated. you pick and choose the data and books to justify your articles. comic collecting won’t end. nor will prices collapse.

best of luck to you

Hey Charlie,

Great article love learning more about how the comic book market gets affected these days, me being a huge silver age collector i have to be mindful on how i invest my money, as much as i love the hobby i would hate to see my investment go down the drain 15 years from now.

Thank you and Best Regards

Izzy

• I’m not sure that I do have many admirers. It’s never been a concern of mine.

• Everything ends Ryan. It’s just a matter of time before you and I become worm food.

• The information is out there. Feel free to collect your own data and interpret as you see fit. Not sure why your so hung up on what I have to say…

• Chat with in my next post about the end of the world.

Smell you later.

Thanks Izzy. There will always be winners and loser in any game. I just think that making good informed decisions today can land you on the winning side tomorrow.

The last comic I bought was in 1978. I didn’t pay any attention at all to comics for the next few decades until my siblings forced me take responsibility for my collection and shift it to my place. I’m a bit like Rip Van Winkle waking up to an entirely unfamiliar comic landscape. That’s why sites like this one, where experienced collectors and investors can share their ideas, are so valuable to me.

Richard may have been unproductively discourteous in the way he challenged Charlie on the evidence for a ‘current retraction’ in the overall comic market, but the points he made seem to me valid, not delusional. The comics that have seen a boom in value because of movie hype followed by a decline would seem to be not the best examples to use as evidence of a general ‘retraction’ in the comic book market. Richard’s look into the market performance of Hulk 181 can’t simply be discounted and the examples he provides of comics that continue to appreciate in value provide a helpful counterpoint to Charlie’s assertions. For what it’s worth, from my trolling of the auction sites, things still look pretty hot to me. But my research is done in a Rip Van Winkle, non-GPA, non-quantitative sort of way. I rely on more experienced collectors to offer their insights. I don’t see any reason why sharing these different views can’t be done in a collegial manner.

Apart from an analysis of the current market picture, Charlie’s post looks at the factors that may shape long-term investments. He raises some really fundamental issues (especially for a guy like me who is wondering what to do with his collection) and that’s why the post has attracted some much attention.

Charlie’s basic premise is that is because comic collecting and even high-value investing requires some ‘connection’ to comic books (a position shared by me and many in the comments), comics will eventually see a long slow decline in value as baby-boomers ‘cash out’ (nice euphemism) and younger people lose their connection with comics. This is a position that instinctively feels right to me. But it’s always good to examine your instincts and engage in a little devil’s advocacy.

In the fist place, I’m not sure it’s entirely accurate that baby-boomers are heavily invested in comics. I don’t want to quibble about who counts as a baby-boomer, but I was born in 1961 and it’s only by adhering to the strictest letter of the law (my father served in WWII) that can I be grouped with that cohort. Doug Schmell and Greg Reece (who I didn’t know about until this comment thread) both started collecting at around the same age and time as I did: early 70s. These guys were pioneers in the territory. The settlers came later. The avid interest in comic collecting and speculating came after the most of the baby-boomers had passed through the ages when kids are typically drawn to comics. So where comic investment is concerned I’m not sure that there is such a large demographic bulge approaching whose passing will deflate the market.

But even if you concede the point (and you certainly don’t have to) that older collectors probably aren’t that old (not exactly the group that conglomerates are buying up funeral homes to cater to.), Charlie’s premise may still hold true, it’s just that the inevitable decline may take a little longer. As Richard points out the real question is ‘are there enough NEW collectors to absorb the selling from older collectors’, and Charlie explicitly recognized the importance of this in the comment thread. What sort of hard data would be useful and possible to find in this regard?

It’s hardly scientific but a quick look at celebrity collectors suggests that interest in comic book collecting is widely shared by younger people. Nicolas Cage is a few years younger than I am. Kevin Smith and Eminem are a lot younger. It surprised me to find that Samuel L. Jackson is a classic boomer; looking good for 68.

Charlie offered anecdotal evidence to suggest a complete lack of interest from younger kids, while Jeff provided contrary anecdotal evidence. I’m sure other dealers can speak about the age of their clientele. For what it’s worth, my own lurking in comic book sites gives me the impression that a lot of people active on these sites are younger than me (quite a bit younger). Furthermore, it’s been my experience that comic book collectors have always been hard to find. When I collected comics with a friend in high school, I never met a single other collector (expect at the comic shop, which was never very crowded, and the one convention I went to in 77). In the years since I’ve stopped collecting I have yet to meet anyone else who collected comics, although I’ll admit I often didn’t enquire. We are a rare breed.

I agree with Charlie in that I don’t see a lot of money coming from the non-English speaking world. But as Jeff Harnett pointed out with comic cons being established in Asia and Europe perhaps they will lead to greater foreign investment. Even if cons are only 20 percent comics, they still generate interest and that may increase investments from younger people in North America and abroad. I don’t know.

I also agree with Richard that services like third party certification, on line comic auctions, the GPA analysis have radically altered the investment picture and can’t be ignored. These services are a testament to the increased value of comics, but they have also added value to comics. They have created a comic investment infrastructure (ecosystem?) that has made buying and selling comics easier, less risky and more accessible. There is obviously way, way more interest now in buying and selling comics than when this Rip Van Winkle fell asleep. How long can this interest be maintained is a fair question, but I believe it will continue well after we straggling nostalgia-ridden baby-boomers have ‘cashed out’.

Even if the big players completely phase out print comics in favour of digital (there will always be artisanal comic book makers) I’m not sure investment in older comics will be affected. The move to digital may even boost the market for old comics, by reinforcing the idea of scarcity. In addition, if digital comic archives can make vintage comics accessible to millions of people, this along with ongoing serialized movies and videos games, may sustain interest in original books and generate demand for the true, sacred relics.

Of course the value of some titles will decline. But as Charlie points out the big players have an interest in continually mining their intellectual property. Will bronze-age (and later) super-heroes amass enough cultural weight to attract collectors over the next decades? I expect some won’t, but many will.

But here’s the nub of the matter. Charlie says Schmell probably regrets selling his collection in December 2012. He could have got a lot more if he sold now in February 2016. But if you accept Charlie’s argument that we should ‘be mindful of the fact that the highs are behind us for now’, then for someone with this sort of collection now should be a good time to sell. Don’t wait. I know Charlie would insist that he is not offering advice. It’s just his opinion. He can’t predict the future. But this is the clear implication of his argument. And it’s a little strange because, I don’t think the factors that Charlie indicated as affecting the overall health of the market are likely to have had an effect in the few years that have passed since the Pedigree sale.

Even though I’m grateful for all the thought Charlie put into his great post, which has provoked so much response from knowledgeable people and inspired me to think about and articulate my own views, I respectfully don’t agree with his position. My collection is infinitely less than miniscule compared to Schmell’s, but I don’t feel it will be less valuable in five, ten or fifteen year’s time.

The primary purpose of my write up was simply to recognize the softness in the market. This recognition is shared by many people who collect. In fact, I received 2 text messages today from fellow collectors inquiring about it… wanting to get my thoughts. One person suggested it might be the result of people having to cover their holiday bills, which sounds more credible to me than the Chinese and German’s who have suddenly stopped buying American comics.

Richard/Ryan/Curious and I have a bit of history together. I find his thoughts all over the place, and often completely contrived. Still, every hero has their Lex Luthor and its this symbiotic relationship that keeps the story moving along. No, I’m not saying I’m Superman.. perhaps I’m Lex Luthor and he’s Superman, but you get my point. I welcome his contribution… if nothing else, it’s entertaining.

The comic market is multi faceted in the sense that there are many collecting streams, many interests and many concerns moving forward. But, for the sake of this discussion, let’s focus on the back issue investment market, i.e.; CGC books.

Movie Hype

Comics have been relatively flat since the big crash. Overstreet keeps propping up comic value but Overstreet is a consortium of retailers who have an interest in seeing the value of books rise. Yes, it’s a huge conflict of interest but that’s another issue. Ebay comes along, followed by CGC and suddenly we have some actual data which tells us that most books are worthless, so everyone focuses on keys, meaning 1st appearances. The days of appreciating books for the art are long gone. The collector market zeros in on 1st appearances and these “key” books begin to rise at a steady pace. 2008, housing collapses the economy, value of books drop, Doug Schmell panics and unloads half his collection. At the same time, Marvel begins making successful movies then all of a sudden, in 2012, comic value shoots up… so naturally everyone credits this sudden shift to movies. People pile in and creating another speculation boom. Perhaps the Germans and the Chinese jump in at this time as well… who knows, but the general consensus seems to credit Hollywood as the trigger. The rise of movie related books creates a halo effect causing non movie related books to also rise, as speculators mine all the 1st appearances they can get their hands on. Adventure into Fear #19 anyone? So, it’s hard not to relate movies to comics. The only reason I’m currently buying up ASM#20’s and MSH#12’s is because I’m betting that the movies will pump up the value of these books.

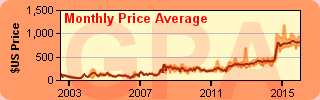

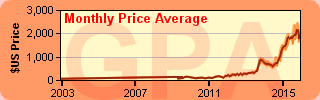

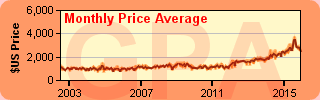

I wrote my piece about a month ago but looking at GPA now at Hulk#181’s, here’s what I see:

9.8 – down from a recent high of $16250 in 2014. Last sale $11702.

9.6 – down from a recent high of $6900 in 2015. Last sale $5350.

9.4 – down from a recent high of $4534 in 2015. Last sale $3824.

9.2 – down from a recent high of $3950 in 2015. Last sale $3350.

9.0 – down from a recent high of $3800 in 2015. Last sale $2801.

8.5 – down slightly down from a recent high of $2775. Last sale $2350.

Of note, this seem to be the sweet spot where Hulk #181’s are concerned.

8.0 – flat, recent high $2214 from 2015. Last sale $2200.

7.5 – down from a recent high of $1825 in 2015. Last sale $1494.

7.0 – down from a recent high of $1599 in 2015. Last sale $1135.

6.5 – down from a recent high of $1418 in 2015. Last sale $1150.

6.0 – down from a recent high of $1525 in 2015. Last sale $1105.

So as you can see, I like to think I have valid reason to suggest Richard is being delusional. This is not to say that things can’t change. But like I state in my write up, the highs are behind us. Perhaps it’s a buying opportunity?

Baby Boomer

Again, focusing on CGC investment books… I invite you to come to TCBS on Feb 21, a local comic show that is growing in popularity. I’ll be set up there as I usually am and I think this show will be a better example of what I am saying since shows like FanExpo have a mixed crowd due to mixed products. If you do come, you’ll notice that most of the attendees are guys and you’ll also notice that they are older guys. Yes, there are a few young fellows buying CGC books but the over whelming majority are guys in their late 30’s, 40’s, 50’s and 60’s. They’ve got the money to buy $100 books, but more importantly, they’ve got the interest. Some are even Chinese and I’m sure there are German’s in the room as well.

Some facts about Baby Boomers:

• The census bureau projects that 974 mil will be over the age of 65 by the year 2030 world wide.

• Currently, the senior population is estimated at 483 mil world wide.

• 78 mil Americans are Baby Boomers.

• Projected increase of seniors is 147% versus 49% US population growth between 2000 to 2050.

• Over 10,000 Baby Boomers will turn 65 every day for the next 19 years.

• Baby Boomers earn about 47% of all US income.

• 65+ workers have doubled since 1990.

• Baby Boomers represent 40% of consumer demand… wow!

• Baby Boomers own 80% of all the money in savings and load organization, yet 24% have nothing saved for retirement.

• Last year, 50% of Baby Boomer reached 50 years of age.

• Baby Boomers control 50% of discretionary spending.

• Baby Boomers spend $7 billion shopping online annually.

• Baby Boomers represent 42% of the adult population in the US.

• Adults 55+ control 75% of the wealth in the US.

• Baby Boomers out spend other generations by $400 billion in the US.

I could go on… the stats are all available online, although the actual numbers may vary depending on your source. Think of how Boomers change our world. By sheer number of births, more hospitals, housing, schools, higher education… etc. Where comics are concerned, unlike the current generation, Boomers didn’t have iPads to play with. Comics were one of their sources for leisure entertainment. There’s no data in terms of how many Boomers read or collected comics but considering their purchasing power, every major business sector seems to be preparing for their eventual retirement. Why wouldn’t we do the same?

Celebrities aside, online forums generally attract a younger audience for obvious reasons (with the exception of this site). But this does not mean that they are reading comics, let alone investing in them. Think of the current print run from Marvel and DC compared to when we were kids. Think of how current books are written and why they dropped the Comics Code. Marvel and DC recognize that kids are not reading their books… or more accurately, less kids. Probably a combination of population decline and more competition for leisure time. Also, people read less, making print seem antiquated. It’s just a matter of time before all the newspapers fold. They keep offering me a free subscription but I have no interest.

Asian Comic Shows

Asia is the manufacturing centre of the world. They have massive amounts of toys and their own line of comics. When I lived in Hong Kong, American comics were more than double the price over there… who can afford that? Especially in China, which is still a 3rd world country. They’ve got tons of shows already… any new “Comic Con” will be tailored to local interests… Why wouldn’t it be? Because Wolverine is so awesome that the Chinese will all want to own a Hulk#181? As well… Asian’s are traditional and comics are viewed as a waste of time… just ask my mother. If we can’t grow the market locally, what chance do American comics have in a place where people can’t read English. How many of us are interest in Chinese comics? Heck, not me… and my wife is Chinese!!

The Nub

I think you got my “clear implication of my argument” all wrong. Doug Schmell sold half his collection to hedge his bets. Because he saw the market declining during the housing crisis and probably panicked. But even then, he didn’t react right away. Yes, the highs “appear” to be behind us but that doesn’t mean that I’m going to follow in Doug Schmell’s foot steps and dump all my books, nor am I suggesting that any one else do that. The market only now just started turning soft… It remains to be seen where it’s headed. What you’re suggesting is reactionary and what I’m endorsing is a more thought out approach. I’m promoting awareness over ignorance. Information over short sightedness. Free will over propaganda. Yes, there is a time in the future that I do plan to cash out but that time is not now. Selling is a personal decision and falls under being informed and exercising free will.

This also doesn’t mean that comics can’t reach a new high later this year, or the following year or five years from now. This all remains to be seen as the colourful line chart that I rendered suggests. I’ve reported on a softness in the market so that people can make their PURCHASE decision more wisely. There is no implication about selling off your collection… why would there be? Besides, what do I care what people do with their books? Sell ’em, keep ’em… make money or lose money… Free will means it’s your choice so have fun whatever you decide.

Ciao Charlie, thanks for the history lesson.

It’s true that I may have a slightly skewed (reactionary?) view of my market options in that I’m not interested in purchasing comics at all. Not because I don’t think there are sound investments to be made in comics. It’s just that I made my investment long, long ago and now I want to make a wise selling decision. Thanks again for the insight. I appreciated your earlier post on selling options and look forward to your next post.

the following is the sales data for Hulk 181 at 9.0 grade for 2015, and 2016 so far.

August 19 saw ONE transaction at $3800. that is a statistically irrelevant data point.

the AVERAGE sale price for the last 36 transactions (including Aug 19) at 9.0 is $2665. Most recent sales are at or ABOVE that. 2015’s first transaction was at $2125. the Average price is 25% HIGHER, and most RECENT 2016 average prices (at $2812) are 32% HIGHER than $2125.

the sky is falling because of one transaction apparently. seems to me it’s the same for all the other grades too. ONE transaction at a higher price, and the comic world is in collapse. look at more than the HIGH/LAST data points, and look at start of 2015, what the average price was, where we are now.. everything is trending higher for Hulk 181’s in any grade from 9.4 down to 5.0 grades

one can make their own conclusions. i wouldn’t take Charlie’s analysis seriously.

it’s one guy writing about the same thing over and over again. collapse of the comic world.

Jan-28-2016 $2,801

Jan-19-2016 $3,175

Jan-18-2016 $2,417

Jan-13-2016 $2,800

Jan-10-2016 $2,868

Dec-06-2015 $2,475

Nov-23-2015 $2,550

Nov-18-2015 $2,951

Nov-15-2015 $2,800

Sep-16-2015 $2,850

Aug-31-2015 $3,199

Aug-19-2015 $3,800

Jul-17-2015 $3,000

Jul-11-2015 $2,550

Jun-28-2015 $2,551

Jun-27-2015 $2,576

May-28-2015 $3,200

May-20-2015 $2,899

May-17-2015 $2,693

May-09-2015 $2,555

May-04-2015 $2,600

Apr-25-2015 $2,900

Apr-10-2015 $2,300

Apr-07-2015 $2,600

Apr-02-2015 $2,350

Mar-26-2015 $2,600

Mar-22-2015 $2,390

Feb-24-2015 $2,350

Feb-23-2015 $2,560

Feb-22-2015 $2,350

Feb-21-2015 $2,500

Feb-10-2015 $2,600

Feb-06-2015 $2,202

Jan-18-2015 $2,325

Jan-17-2015 $2,500

Jan-02-2015 $2,125

2 points, comments. There are various comic book Markets with trends within each and with refined subtle and blatent overlaps. Report; In Dec The New York Historical Society Exhibit Gotham City Super Heroes Superman, Batman,Wonder Woman, Spider-Man, Iron. On display- an Action 1, Batman 1 , and a Wonder Woman 1. and the kids were there looking amazed as if they were ancient treasures !! Have a nice day, and some how wish for the best!

I forgot to mention. Check out Alter Ego Jan #137 issue .Article on the very first comic book convention in 1964. I was one of the 50 people there–good feeling but boy do i feel old! Ha!

Ryan, even if you excluded the one sale of $3800 in 2015, there are 3 other sales north of $3000, and several just right below. In 2015, the Hulk#181 clearly shows an upward trajectory until at about November where the prices begin to slide. The 5 sales this year all remain below $3000, except for the one at $3175… so what is your point again?

Averages can be misleading because a book can be propped up or held down by a few exceptional prices either way. It’s one way to look at data but it’s not the only way. In this particular case, I feel the average misrepresents because the Hulk#181 has had such a run up and several early sales from 2015 range $2000 to $2500 that the impression, when looking at just the averages, is that this book is on the rise. However, if you look at the individual sales, the opposite is true… for now anyways. This book is higher now then it was this time last year, but it appears to be past its crest. Just look at the line chart that’s been posted… Are you blind? I don’t see how you can say otherwise.

You can keep putting words into my mouth but it still doesn’t make those statements true. Keep spinning you brand of truth all you want… all it demonstrates is that you don’t read very well. As I state in my last comment. I simply don’t care what you do with your money. Knock yourself out and keep buying… because, hey, once the rest of the world watches the next Wolverine movie, everyone will want a Hulk#181.