Over the next couple of weeks, I’m going to focus on sharing some thoughts on investing in comics. I know a lot of you reading the column focus more on collecting but there are just as many who play at investing, it’s a topic worth discussing. I also know that some of you reading this are successful old veterans at this game, from you I’d like some insights shared because good karma is good karma.

Investing in comics has been one of the most profitable ventures these past 30 years, the returns for collectors lucky enough to start early and even luckier enough to keep all their stuff is astounding. If only we had a time machine. I’ve always been an optimist in value growth for comics but even I get the sense that comics collecting and investing is now an established and mature hobby. I’ve had this notion in my head that the apex came just before the release of the Avengers End Game movie. It seemed like there was a 20-year build-up to that movie that saw so much new money flood into our hobby.

Don’t read this wrong, we are in a great spot in the hobby, a very very large number of comics now have real liquid values that if you travelled back in time and told someone from 2004 of their values they would laugh in your face. Collectors who have been at it for a while are sitting pretty right now.

I don’t want to look at those collectors and investors of the past, I want to explore the prospects of collecting to invest for the future as of this moment.

It’s easy to invest in a big Bull Market, just buy at today’s prices and sit back and watch your investment grow in value. All Bull Markets have their run and comics have had theirs, and they may yet have another. There are still strains within the hobby enjoying strong price increases but I’m sure we can all agree that the general market has plateaued and in some spots, it has given some of the recent gains back.

Now we have to develop strategies, spot trends and make informed investment decisions if we want to buy comics for future profits. I don’t think a good investment strategy is just buying and buying hoping that something in the pile will ignite because of some movie announcement, for that windfall you should already have the book randomly in your collection.

Let me backtrack a bit, in this massive price run-up we’ve seen over the past few decades we’ve come to a point where there are so many comics worth real money but I’m someone who believes that there are too many books in this mix that don’t deserve their current values and that the coming years will see these books correcting downward. Remember everything got swept along even undeserving books so part of our investing strategy should be knowing what not to buy. Just as the price run-up has included undeserving comics it has also brought up books that can bear much more market value, these books are being hidden in the large pile of books that we assume have had healthy price run-ups and we just assume the market got it right. The market didn’t get it right, the market is too small and too fragmented and too busy chasing the flavours of the month to get every book right, there are good books well under value still out there.

What we need right now is a Warren Buffet style of comic investing, let’s look at the fundamentals behind the book, let’s look what it brings to the table, let’s assess its long term viability as a collectible, let’s see if the market has it right. Such easy things to right down. So hard to put something like this into practice but that’s the point of this blog, this is relatively new ground for most of us, I’m sure some very savvy collectors and investors have been practicing for decades. I think its time we develop the skill set needed to make some smart choices.

So where do we start? How about some sort of checklist? Maybe it’s too simple and not nuanced enough but we have to learn to walk before we can run so maybe the fundamentals will help.

Many of these fundamentals have been repeatedly covered here on Comic Book Daily. The checklist should at least include, first appearances, first cover appearances, first artist work, historically significant comic and massive cover appeal for whatever reason comics. Each of these will have sub-sections like heroes, villains, love interests, aunts and uncles etc for first appearances. From here we should consider supply – scarcity, relative scarcity and scarcity of grade (go back to my scarcity of grade post for how to predict future scarcity levels of CGC graded books) and we should note current demand (remember soft demand could be good for us if many of the other items of the checklist are present). This is good enough to start, you can add a few more things that you believe in and start from there.

We now have our checklist. Next, we actually need to do work, to study, to go through data and try to see patterns, spot trends and start using this data to start targeting books that are emerging as potential books of interest. Let’s take some notes, open a spreadsheet and start recording sales values. The best thing that can happen to us is that we end up spotting a book or two that we zeroed in on and that book ends up increasing in value, even if its before we had a chance to buy it. Success! we are on our way.

This was a simple and rushed overview I know but I wanted to get the ball rolling, next week I’m going to share with you an example of how some research and some connecting the dots can lead to great investment opportunities in comics.

Walt, there are so many YouTube ‘horror-story’ videos I’ve watched where many dealers show and tell about the plethora of real garbage coming into their stores. Untold thousands of worthless comics, bought in earnest by people hoping to retire with a winfall, that this column seems a bit too little too late.

New comic fans, in a large way, don’t want to be saddled down with large holdings of collections these days which may or may not be worth something someday. These newer generations are pretty much contented with digital offerings that they can tote around on their phones, and read them whenever they want. The YouTube videos seem to support this unfortunate state of affairs, especially nowadays, in this time of covid.

While I count myself among the group of collectors, its not like I am unaware of the worth of my collection. While its also true I have no CGC comics currently in my collection I AM open to having some graded eventually and have even looked at a couple graded books for possible induction into my collection!

I can say that I have kept my books in as close to the condition I purchased them in whether that was 40 years ago or last week and try and be a shrewd buyer when purchasing. Rarely do I feel I have over paid for a book and many times I have felt I have come out way ahead…and I always include my shipping as how much I have paid for a book! A great example was I got the entire run of E.C.’s Valor in fine for less then $50… including shipping because $25 was for shipping… would YOU pay that shipping if you could get those books for five bucks apiece? I had a similar incident with an M.E. Ghost Rider #1… the shipping was high so no one but me bid and I got IT for less then $50 as well!

While I am aware that the bulk if my books are of relatively low cost ( were are talking $15 and under) I still have a lot of significant books worth money… heck I have been a collector for 50 years! Reading and listening to Walt, ChrisO. and others on CBD has effected my judgement on purchases, changed my attitude on graded books, but also made me realize that I can make wise investments even on lower grade books provided they the right books! I appreciate the business angle take on comic collecting, and if you haven’t done so, read that business section in the Overstreet… it really is fascinating!

This right here is my biggest problem with “older” comics….social media has made it impossible to buy older comics and to an extent newer comics or sought after variants\ratios\incentives because now all you have to do is reach into your pocket and jump on your phone and go to whatever website you want and trust to see what these books have sold for …literally up to the minute sales (eBay, cgc forums, variant forums, GCP…etc, nobody now can find a book for a “great deal” anymore and watch its value grow substantially…that doesn’t happen anymore….were in a time that if you want a book…you’re gonna have to buy it at it’s worth or maybe find a “good” deal or trade for it or trade plus cash….but the days of finding any books like the ones mentioned in this article by hunting and researching and putting in the work are long gone…and because of this we now live in this dreaded speculation market where anyone with a YouTube channel or Instagram account can drum up fake hype over newer books that really don’t deserve it and the masses will follow because they want to hunt, they want to get that “hot” book for cover price, they want to collect..and unfortunately this is the only way now.

I just feel it’s a little to easy to say …yes you should go after first appearance’s, cover appeal, artists first work….sure those books are available and any novice collector knows that….but you will need the means cause you are not going into a con or comic shop these days and finding those in the cheap boxes…if you want those books you’re gonna pay what the collective market thinks they’re worth

Gerald, I love reading the Overstreet yearly market reports. They’re so informative, and from people who know what they’re talking about. I especially like it when they talk sbout obscure items I’ve had for years and are now, finally, starting to show some interest

A funny story: I used to work in a shipping warehouse where my co-workers knew I liked comics. Back in the 90’s, one co-worker approached me, slammed his hands on the lunch table, and said, “Death of Superman, how many can you get me?” He didn’t like my answer when I replied ‘none?’ and so he walked away mumbling, “so what good are you?”

Why do people think comic collectors automatically have an inside line on everything related.

Walt I’m sure this will be an interesting column that you’re working on. I will say from my observations over the last month and a half, (raw)comic prices at auction have been going for ridiculous prices. There are comics that I thought were junk going for exaggerated prices.

Angelo, there is zero wrong with knowing the fundamentals, 1st apps, 1st covers etc, this is where you start and build from, don’t just brush that aside.

With this post I’m trying to say that yes we can still find winners, lots of them, its just now we have to work harder and think harder.

Lets not just sit there and lament that almost all comics are worthless, almost all comics have always been worthless, we are focusing on the ones that have value. The general run that had almost everything across the board rising in price may have ended but that does not mean comics will not continue to appreciate in value.

Digital comics are great for people that want to read comics digitally but digitally reading FF #1 but people actually buying the FF #1 are not buying it to read.

I’m saying there is still a lot of opportunities out there and those able to read the data correctly will be taking those opportunities.

Hey Walt, I couldn’t find any local buyers for my books so from the list I sent you, I picked out 60 and sent them down to ComicLink. This is only the second time I’ve submitted books to be auctioned off so I’m a bit nervous about it, especially since the first time was a bit disappointing. Am I nuts to be auctioning off my books during these crisis times? Well… there’s a strategy to my thinking and I’ll let you know if it pans out.

I think what most people don’t realize is that BUYING comics, or stocks is the EASY part. But, knowing when, how or where to sell is the hardest part of the equation. Folks who are currently hoarding comics and have never sold books before are in for a rude awakening. So depending on your age, I suggest you get learning… fast. And there’s no better teacher than experience.

I’ve posted stats on average income before. That hasn’t changed, but the value of comics has. I was buying Hulk #181, 9.2’s for about $1k back in 2012. But today, they’re trading at $6-7k? But has our income also increased 6 or 7 times? There are dealers the US who are hoarding stock piles of books like Hulk#181. They consider this their retirement plan. If you’ve ever played the game hot potato, then you know how to win the game.

These are very interesting times. Trump is printing money like there’s no tomorrow, while the stock market zigs and zags as the US heads into an election. Corporations continue to receive massive amounts of free handouts, but also the Feds are buying junk bonds from so called “fallen angel” companies. What does all this mean for comics? It means our wealth is going to get further devalued, making comics that much more expensive. Comics here in Toronto is just over $5 after tax. Is the market ready for $6 comics? I’m guessing $6.50 very soon. They’ve already been testing the waters with their premium covers in order to get buyers use to the idea. See clever they are?

Warren Buffet is a value investor. Value investing in comics is kind of an oxymoron, because it’s primarily about taste. Although, if you wanna use Act#1 or Det#27, I’ll give, due to their historical value. But very few are in this class of books. The future belongs to the young and if you wanna know where things are headed… look to he young.

Hi Walt…I don’t think you meant that reply for me, no where in my post did I say apps were bad, mention digital comics or anything about worthless comics.

-Angelo

@ Walt, just to clarify…No where did I say apps were bad, I just said they were tools now made available to us buyers\collectors and everyone that now prevent collectors from finding that “great” deal no matter how much work, research, blood sweat and tears we put in…gone are the days some old shop owner pulls out a dusty over street from below the counter guys and flips through it…if those guys still exist I wanna shop there!!

Apps means first appearances to clear up the semantics! Charlie, while some of our collections won’t allow us to retire on the income, there will always be a nostalgia factor for people and comics will be a part of that. Look at all the antique stores around with the majority of people buying being younger then the collectables their buying. Sure there are those books that have sky rocketed due to demand but there many that slowly and steadily increase! The only comic series I can think of that has barely increased due to inflation over the years ( tho I am sure there are others) is Little Lulu! Thats a series you will never expect to retire on!

Gerald! Whadya mean I can’t retire on Little Lulu’s? Well thank goodness my Hot Stuff the Little Devil will provide the reassurance I need.

Only if Stumbo makes an appearence Chris!

The old Dell (and other 50s) westerns have taken a massive kick to the curb.

A friend buys them regularly, paying as little as 5% of guide value, simply because no one else wants them, and he buys them strictly for the beautiful painted and photo covers. The conditions are fabulous and the dealers on eBay are willing to, virtually, give them away to free up their boxes.

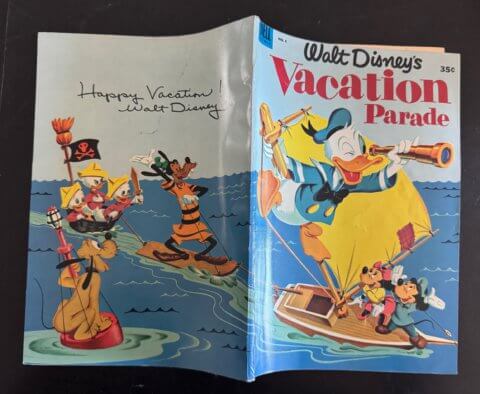

Other Dell/Gold Key comics are similar, there for the taking, having lost so much of their values.

I don’t know if those painted covers will take off on the Dell’s ever but those painted covers would be great poster size in a man cave!

Charlie! Very valuable insight you’ve added and one worthy of its own post. You are so right when you say that selling more an issue than buying. Arming ourselves with the knowledge and skills to buy well is only half the job, we have to know how to sell as well. I think you did right by sending those down to Clink, the market seems to be good at the moment – stimulus money? I don’t know but you are about to find out. I’ll be watching those results.

Angelo, only the first paragraph was a reply to you and it was in response to your “…it’s a little easy to say…” comment. I do agree its easy to say but I still think its worth saying because it is the fundamentals.

Back to Charlie, I think the majority of people buying their weekly books are consumers, they want to read the stuff and collecting them for investment is not their primary reason to buy them. I do agree there will be a price point where its just not worth the 10 minute read.

Gerald: My friend is an artist and reproduces those painted covers in large versions for his own private collection.

Gerald, I’ve been to those antique stores. I even wrote about it in a past article. I’ve also spoken to many of the vendors as well as the managers of those venues. Southern Ontario is littered with antique stores and collectable shows. In fact, there’s a show almost every weekend some where within 2-3 hours driving distance from where I live. I agree that the nostalgia force is strong and it will always be with us. But, as far as the value of old collectibles is concerned, it comes down to simple supply vs demand.

Agreed Charlie! There are regional differences as well! I know I have seen mid century modern dinette sets that in small towns sell for less then $25… and Manhattan boutiques sell the same item for $1500!

Ultimately, the biggest factor of a comic or other collectible’s worth in the future comes down to nostalgia. I could barely give away my collection of Dell and Gold Key TV comics a few years ago (My Favourite Martian, I Spy, Land of the Giants, etc.), but they were still sought after into the ’90s. Very few children or teens currently read physical comics, so there will be almost no nostalgia for them in the future. In 25 years the nostalgia cycle for the MCU movies will be high and the blue chip AF 15, Avengers 1 & ToS 39 should retain their worth. If it’s not in a movie the appeal will be limited. As a collector for forty years, it’s been interesting, fun and sometimes lucrative to see trends come and go. My Dell Giant Little Lulu is no longer wanted, but who knew I was holding on to treasures like Eternals 1, Jungle Action 6, Ms. Marvel 1 and Strange Tales 169 (not to mention Iron Man 55)!

Well David you never know… those Guardians of the Galaxy weren’t sought after all that long ago… and you know how they are now! Now to just convince Hollywood that Little Lulu will be the next big sleeper hit if filmed! Ok…. maybe not….BUT… maybe the business savvy amongst us can say if the Archie Riverdale show is affecting the comics… any change guys?

Hey fellows, are you saying My Dells, Harvey’s and Little lulus have little value? Not to worry…Walt sold me a Run of mid grade Sgt Fury’s.

He said it was a steal of a deal 😉

Changing tastes and nostalgia are funny things. I became an ebay member /buyer around 1999. Little Lulu was a big ticket item for 10 years. Especially the four color andfirst early 25 issues. And boy, has that changed. Having said that, they were great reads. And my favorite issues are the spinoff Tubby issues with Sammi the martian and the leader of the Little Space Men. What a joy and a hoot. Recommended reading and cheap collecting…Marge’s Tubby and the little men from Mars (25 cent cover/giant)

https://comicvine1.cbsistatic.com/uploads/scale_small/6/67663/1580565-01.jpg

Dave MacKay, that Fury deal was a great deal, I didn’t say for who.

Gee Dave… I hope Walt at least threw in a run of Capt. Savage and his Learherneck Raiders to make it a better d….errrr…. nope… Walt would have still made out….

😀

Big Topic so it took some time to put my thoughts together.

Firstly, the recent apex hit in 2017 at about 15% price growth, the highest since 1997 which had 17.5% growth coming off the speculator boom of 1995-1996. Why so high in 2017? I have an idea but lets keep it real.

Since 2017, by year, 13%, 10% and 5% for 2020, so far. Comic growth for 2020 was going to be about 5% whether or not the economy imploded, unless someone sold a Detective 27 or Action 1 in 9.2+, which would throw things for a loop.

Investing? I ran numbers equivalent to the Dow 30 from 1976 to date and created a comic book equivalent. In 1976 the Dow carried Sears Roebuck, FW Woolworths and Steel companies. The Dow drops companies periodically so I did the same at equivalent times and added the highest valued 9.2 graded books, not the greatest gainers. As such I dropped the original lesser lights such as two Kite Fun Books, March of Comics, etc. The current Dow is about 25,000 points, the Comic Book Average sits at 240,700 on May 6th. However trading on the stock exchange costs $9.99 and you do get Dividends. Comic investing is worth it for the right books.

Of note eight comics made it from 1976 to date, the two we may not think about are Whiz 2 (1) and More Fun 52, the other six are obvious. Also of note the Dow had 12 dips in value, comics had one dip in 2003, but the overall comic market on the whole has always been on the plus side.

The future of comic collecting can have some certainty by looking at the recent past. I reviewed the top 50 comic book gainers between 2001-2020 and 2015-2020 from my own work and they are categorised below:

Note: I have added the composite gain rank for each comic. I also am not saying the reason for the great increase is legitimate.

1. “Found comics”: these are comics that have recently been upgraded in value through ‘new’ information. These include: #1. United Comics 21 (first Peanuts), 2. Manhunt! 12 (A Canadian comic and rare, although I saw one auctioned and one sell on eBay), 3. Tip Top Comics 173 (also first Peanuts), 12. Wonder Woman 98, (now the first Silver Age issue) 23. Peanuts 1, not a found comic but given the Peanuts popularity above I put it here. 26. Patsy Walker 1 (now Hellcat)

2. “Batman Joker covers”, especially dark covers. These include: #4. Batman 37, 5. Batman 44, 14. Batman 52, 24. Detective Comics 69,

3. “Movie”: 6. Tales to Astonish 13 (Groot), 41. Tales of Suspense 52 (Black Widow),

4. “Atomic age girls interacting with male character(s) covers”, What? Yes, this is a thing, although good art and having headlights on helps. #7. Gay Comics 32, 9. Cindy Comics 37, 10. Sherry the Showgirl 1, 11. Diary Secrets 30, (also a Matt Baker cover), 18. Teen-Age Romances 9 (Matt Baker beach cover), 21. Seven Seas Comics 6 (Matt Baker cover), 22. Archie Comics 50 (lots more going on with this cover), 30. Betty and Me 16, (innuendo cover), 32. Millie the Model 3, 36. Teen-Age Romances 14 (Matt Baker cover), 37. Millie the Model 2,

5. “Batman-related First Appearances”: #8. Batman 121 (Mr. Freeze), 42. Detective Comics 359 (Batgirl)

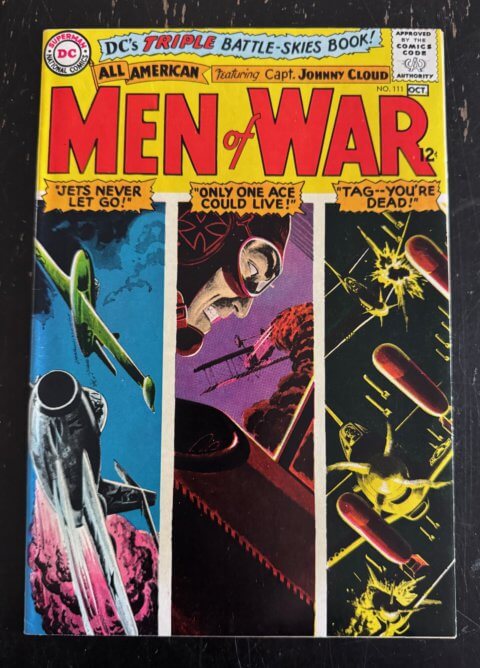

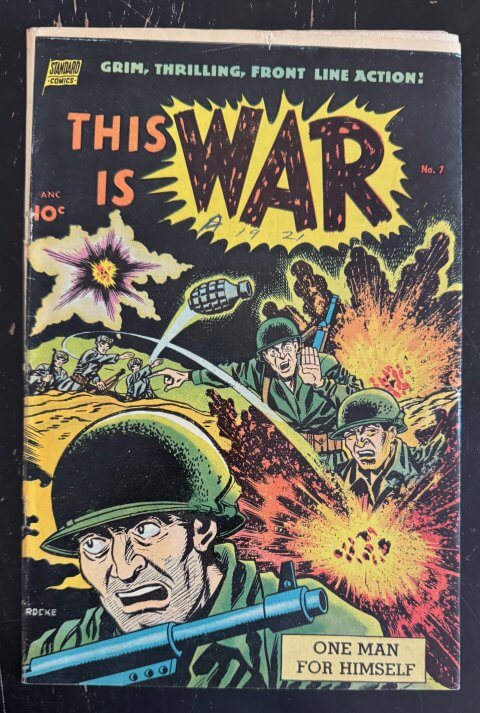

6. “Great Action covers” 13. Pep Comics 16, 16. Suspense Comics 4, 20. Pep Comics 8, 35. Mystery Men Comics 8, 38. All-Select Comics 4

7. “Nazi”: This category could easily be broken down into Hitler and esoteric Nazi covers. Esoteric is used when the villains or actions on the cover likely did not exist during the actual war. I will do my best. 15. Prize Comics 37 (Hitler), 17. Headline Comics 8 (Hitler), 27. Zip Comics 22 (Skeletal Nazi reaper), 29. Speed Comics 28, (Giant green Nazi monster), 31. Speed Comics 24 (American flag hoisted over Swastika in Berlin), 44. Thrilling Comics 41 (Hitler tied to bed), 45. Mystic Comics 8 (Nazi Iron Maiden torture chamber in use), 46. Pep Comics 34 (Nazi vampire-like creature with hypo), 47. Captain America Comics 46 (Holocaust cover), 48. Exciting Comics 39 (Nazi soldier selling poison candy to kids) 49. V…- Comics 1, 50. Zip Comics 32 (Fighting skeletal Nazi soldiers)

8. “Great horror or gore comics”: 25. Spellbound 14, 28. War Fury 1, 33. Strange Tales 28, 39. Roly-Poly Comic Book 14, 40. Chamber of Chills Magazine 19,

9. “Great comics we already knew about” 19. Pep Comics 36 (first full Archie cover), 34. Star Wars 1 (35c variant), 43. Action Comics 10 (Superman cover)

Number 51 is Archie’s Madhouse 22. So where are we going? Find something cool and go for it, if there are two of you wanting the same thing and you have lots of spare money then prices will go up. I will stop for now.

Great insights Alex, I’ve cut an pasted your points and have reread them a few times, nice work.

I would change two things. Millie the Model 2 includes Millie dressed as the Blonde Phantom, which may be a first appearance, but I don’t know the publishing dates. Secondly Star Wars 1 probably should go under “Movie”.

I was an Archie fan and collected the Atlas/Seaboard titles in the 70s. As a result, I ended up with 10 complete mint sets of Vicki 1-4. Who knew?