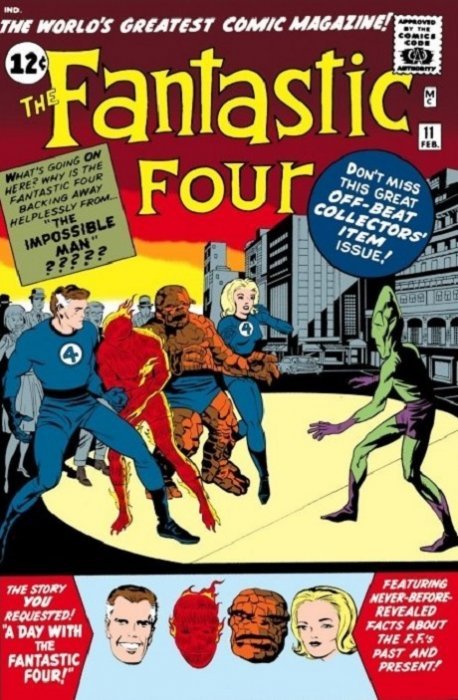

Fantastic Four #11, Marvel Comics, February 1963.

Here’s another book I pulled off the “future Spotlight” shelf, it’s a book I’ve owned many times and it just may be the most liquid issue of the Fantastic Four between #6 and #47. This week’s Undervalued Spotlight pick is Fantastic Four #11.

It’s true what I said above, Fantastic Four #11 is the easiest book to sell in the run between #6 and #47 and this is because at the market prices its been holding over the past two decades the book is seen as and is a bargain.

Fantastic Four #11 features the first appearance of the Impossible Man, a character akin to Superman’s Mr. Mxyztplk. Mr. Mxyztplk first appeared in Superman #30, an issue I featured back in Spotlight #359. Comics.org notes that Superman (DC, 1987 series) #50 (Dec. 1990) depicts Mr. Mxyzptlk on a vacation as the Impossible Man harassing the Fantastic Four, with dialogue taken from this issue. This connection is great and only adds to the whole desirability of the character.

Fantastic Four #11 is early days Marvel and this fact alone should be enough to spur value appreciation in the coming years. The fact that is it embedded in the Fantastic Four run, a run with major upside, the fact that it predates Tales of Suspense #39 and Amazing Spider-Man #1, the fact that it is one of the very coveted and highly collected round 12 cent early Marvels all point towards good future prospects for the book.

The markets are choppy and mixed for Fantastic Four #11, a CGC 8.0 went for about Guide at $1235 while solid grades like 6.5 and 7.5 are seeing price drops.

My play here is a CGC 8.0 White pager with stunning high gloss, this book with its deep dark colours looks amazing with high gloss.

The 48th Overstreet price breaks for this book are $1196/$2698/$4200 in the 8.0/9.0/9.2 grade splits.

Strengths that make this comic a good long-term investment are:

- First appearance of the Impossible Man

- Early days Marvel round 12 cent cover

- Predates Tales of Suspense #39 and Amazing Spider-Man #1

I like your comparison with the DC imp and Marvel’s guy.

The late Dave Cockrum once told me that a similar joke circulated around DC and Marvel that Supergirl/Linda Danvers and Ms. Marvel/Carol Danvers were one and the same; that between her gigs at DC, Supergirl go over to Marvel and work there. An earlier version of the same joke said that Supergirl picked up extra work as the Black Orchid in that heroine’s Adventure Comics run.

It’s funny how TPTB in comics create these little scenarios to amuse themselves. Dave even did me a nice sketch depicting Supergirl and Ms. Marvel landing side-by-side, to prove they weren’t the same person. I would have preferred Supergirl opening her blouse (be nice now) to reveal a Ms. Marvel costume and thinking, “Darn, I wore the wrong costume again! The DC guys are gonna be pissed!”

Walt – Enjoyed the column and this issue is one that I have on my list to acquire. But often, as collector, I am content to acquire a mid-grade (6.0 – 7.0) and wondered what, in your opinion, is driving price drops in mid grade copies?

I understand a “flight to quality” for high grade copies potentially driving appreciation, but if the issue is in demand (and given the limited supply of high grade copies of an early Marvels) it would seem mid-grade would hold its own rather see falling prices.

Great comment Tony, thanks for sharing, makes you think of all the inside jokes and pokes that litter the old comic landscape that we may never know about.

Derrick, I don’t think there should be a price drop for 6.0 copies. I do know that low grade copies of many desirable books have enjoyed a raising of the “floor price” in recent years and as you mentioned the high grade stuff seems to always go up. I’d bet that most of the market activity is currently at both ends of the grade spectrum while the middle stalls. Things do have a tendency to change though.

Dave told me of a great drawing by the late Kurt Schaffenberger that used to hang on Julius Schwartz’ wall, depicting Brainiac, bent over in front of a completely nude and wide-eyed Supergirl, after tearing her costume down to the floor, yelling, “Logic be damned!” I would have liked to have seen that one. 🙂

It’s natural to look at this book with FF #1 doubling last year, while this book basically hasn’t moved since 2004 (at least). You’ve listed the pros but there are cons:

– I see the “first ten issues” strain at work in a lot of titles, and this is #11.

– This is pretty much a run book. Yes Impossible Man, but he is a goofy character like Bat Mite and doesn’t fit into the cosmic continuity. Also in these days virtually every issue was some sort of first appearance.

– The cover is weak. Some tension but otherwise standing around and floating heads. Imagine if somebody submitted this for publication today (sincerely, not as some kind of throwback homage).

Just last night Batman #5 sold way under my estimate based solely on numbers, and then I went and looked at the book’s silly cover and was glad that I had forgotten to bid. That is a much less common book and a #5. I don’t think the new money is going to be too interested in FF #11.

So I am not seeing any hooks that make me want to support this book. The next step is comps. I think there are a lot of possible comps but I will be lazy and pick just two: FF #9 and FF #15. I think these are pretty generous comps – not much is going on in FF #9, but Sub-Mariner is on the cover and it is in the first ten issues. #12-#13 are clearly off the table, while #14 is another Sub-Mariner so I will move to #15, which has a first appearance (Mad Thinker) which probably is a little more salable than The Impossible Man.

These are pretty early books so it doesn’t make sense to look at very high grades, so I will just look at 6.0 and 8.0. I don’t think the very long term is relevant to the analysis in the context of the title. FF #1 just took off in mid-2017, so I think comparing to something like mid-2015 will give some sense of how the market is moving. Here are my estimates of the price changes over that period:

FF #9: 6.0: +20% 8.0: +45%

FF #11: 6.0: +5% 8.0: +30%

FF #15: 6.0: 0% 8.0: +5%

I don’t see any sign from this that #11 is lagging. It does seem to have some movement in higher grades in line with the broader market – there was an all-time high 9.0 sale just a couple of weeks ago.

So I am not buying the undervalued call. However I am not arguing against this book either – it is an early FF classic that should hold value. Aside from The Impossible Man somehow getting the Disney treatment, I think the play is “bullish FF”, arguing that the whole early run moves up. I think that is a very long shot if you look at how early Avengers have performed. But if you want to pursue I would turn your recommendation up a notch and argue for a bargain 8.5 with the gloss you are talking about. You could get lucky and get this for around $1500, which would be a bargain compared to the most recent 9.2 and 9.0 sales, and would be considerably scarcer than an 8.0.

Verdict: Improbable but not Impossible

Nice breakdown Chris though a bit on the fence-ish. An important thing to note, we are dealing with comic books and as we all know, nothing is impossible.

I love impossible Man – there I said it!