Over the weekend I visited a new comic shop and picked up a few books. When I got home and checked my receipts I noticed I was charged the full HST amount. As usual my first reaction was to be incensed over their lack of knowledge as a retail store in Canada selling books. It was a sale event and perhaps the cashier didn’t know what was what, but it’s a problem. So here’s my educational moment.

First of all I blame this lack of knowledge on the industry’s desire to call graphic novels, trade paperbacks, collected editions, periodicals, and every other format a graphic narrative appears in to be a “comic book”. Using that criteria the consumer would pay the full HST amount. Since we know there is a very clear distinction, then different rules apply.

The Canadian Revenue Agency has a wonderful document available with clear information and even clearer examples. Read that here. Books are charged 5%, periodicals full HST. It’s considered a provincial tax rebate to the consumer at the point of sale and is only in Ontario, Nova Scotia, New Brunswick, Newfoundland and Prince Edward Island. Alberta doesn’t have a provincial sales tax.

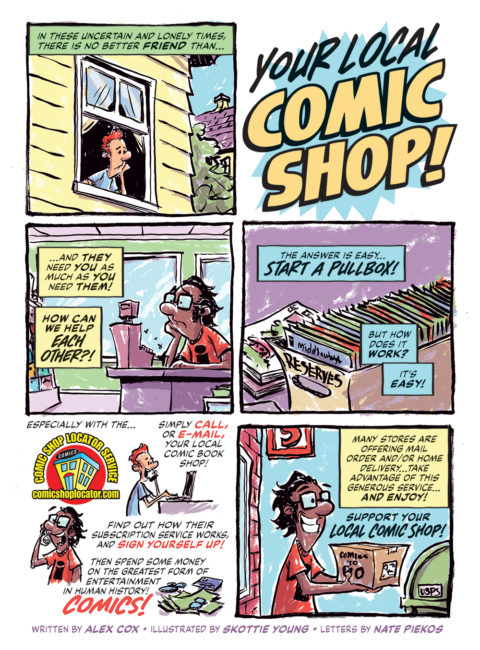

Let’s apply this to comics since this is a comic site. Any comic “book” (softcover or hardcover) only has the 5% tax applied to it. Any periodical (your monthly comics) has the full HST applied. There seems to be some wiggle room for periodicals with less than 5% of the total space used for advertising. As well periodicals purchased by subscription only pay the 5% tax but that would be a stretch to apply it to a pull list unless you paid upfront.

Unfortunately there’s no distinction between new and used books and periodicals so the same tax rules apply to back issues.

For those of you know have paid too much tax, take note: you can get that money back as long as it’s more than $2. Get the form here. If your local comic shop is charging the wrong tax amount I suggest printing off the PDF above and giving it to the owner.

Exactly why I stopped buying books from my local comic store. He’s know the rules but chooses not to comply.

I have read the CRA document and it states that only comic books purchased by subscription qualify for the point-of-sale rebate and that comic books purchased on a per copy basis do not qualify. Have you successful obtained a HST rebate for HST on comic books?

Yes I have, but only on collected editions of comics. As I said above it only applies to “books” of comics and not the periodical monthly “floppies”. Here’s a quote from the article:

Example 1

A bookstore in Ontario sells a hardcover novel to a consumer.

As a printed book, the novel is a qualifying book for purposes of the rebate. As a result, the bookstore collects only the 5% federal part of the HST and pays or credits the rebate equal to the 8% provincial part of the HST to the consumer at the point of sale.

my comic store is charging me 20% for us conversion and then another 13% tax. Does that seem like way to much? Now a 2.99 comic is costing me about 4.40

The current exchange rate is about 27% so you’re getting a deal there. Periodical comics (monthlies, floppies) contain ads and are subject to the full HST amount, so 13% in Ontario. Collected Editions, trade paperbacks, hardcovers all would have 5% HST.