I’ve got a lot of things I’d like to discuss but I’m gonna have to put that on the back burner because this past weekend was the Toronto ComiCon, 2017!

I usually split a booth with someone but this year I went solo, although I did have someone to help watch my stuff and keep me company. Business was slow during the first day but progressively got better. I was slashing prices on Sunday and it was busy enough that it became difficult to leave the booth for a walk about. Financially speaking, this was my best performance for this particular show, which sounds good when I say it out loud but after expenses and the cost of setting up… it’s not necessarily as glamorous as it may sound. Still, it was fun and I managed to clear some unwanted inventory and lost about 5 lbs while doing it.

Lots of other people also seemed to have done well, but among the… “I had a great show!”, “I’m did really well” and “what an awesome weekend” there were some long faces and the usual complaints… “no one is buying comics”, “the show has become too expensive” and “the prices are to high”.

From my perspective, I felt that the show was very successful and I’m always impressed by how well these larger shows are run. However, I like to delve deep into issues… so, instead of me telling you how great everything was, I thought I’d examine the most common complaints that seemed to creep up every year. Being enlightened means that we can think critically and are able to look at issues through various lenses…

What I hear often, year after year is that:

• The show is too expensive and the organizers are to greedy.

• The patrons are cheap and most are simply here for the media spectacle or for cosplay.

• No one buys comics any more or comics are priced too high.

The 3 main lenses that I’ll be looking through are:

• The host.

• The guests or patrons.

• The vendors (primarily comic vendors).

Okay… let’s break it down…

The Host

Is the cost of setting up too high? Is the admission price too high? Is the cost of comics too high? Is the cost of changing a simple light bulb in your car too high? How about a pair of jeans? Or ink for your printer? Or restaurants that insist on a minimum 15% service charge on top of the overall bill which includes tax? The quick answer here is… damn right the costs are high! But so is everything else. Is the organizer greedy? Are the comics overpriced compared what they’re selling for online? Do buyers want valuable books without paying full price? Of course! After all, money makes the world go around and we all want as much of it as possible. The Toronto ComiCon is a business. Corporations exist to make money and a well run business knows how to maximize profits. The real question we should be asking here is, are they doing their job? In exchange for the cost of setting up, it’s the organizers responsibility to promote the show and get people inside. I would say that they’ve done that. I was impressed by the turn out and was encouraged by the overall interest. If anyone knows how to put on a show, it’s these particular people. They’ve got the experience, the brand recognition and an audience that they’ve built from years of hard work, so why shouldn’t they be rewarded for this? Vendors paid to have access to this audience and this is exactly what we got.

The Patrons

So then, if Informa did their job properly… is the comic audience too cheap? Perhaps they are, but let’s look at the big picture here. As I briefly mentioned in my last post, the buying power of the dollar isn’t what it used to be. Gold appears to double every 10 years, but it’s actually money being devalued by 50%, which is basically what inflation is. By my calculation, if you have an annual salary of $100k, at the current rate of inflation or devaluation, your $100k has the buying power of about $25k to $30k from our parents era, which is not a lot of leverage. By the time the patrons are on the show floor, they are already out of pocket the high cost of admission, parking and have yet to buy an $8 slice of pizza for lunch or a $5 bottle of water to stay hydrated. All this before they can even consider buying that beat up copy of Amazing Spider-Man #300 stickered at $400, in hopes that the book will increase in value on news of an upcoming Venom movie. Resources are stretched thin for most people, and if you have dependents, the cost to attend is compounded for families. So you can call it what you want but I prefer to view this as being careful. Considering the amount of debt people carry, I think careful spending should be encouraged. Ultimately, you want people to be happy with their purchase decision and those who paid for admission should be made to feel welcome because without the patrons, there is no show.

The Vendors

As they say, the definition of insanity is to continually do the same thing but expect a different outcome. Based on this description, I can tell you that some vendors are indeed insane, for choosing to operate as they did decades prior. As both buyer and seller, I can be sympathetic but only up to a point because I don’t understand why some people refuse to acknowledge the cultural shift that is taking place. As well, the market is more fragmented than it’s ever been, and I’m not talking about toys, games or even technology. With a 75 year history within comics alone, there are more stories, more publishers and more creators than ever before. All resulting in more strains of interest for both readers, collectors and speculators. From old books, new books, hard covers, soft covers, variants, art editions and other formats… all multiplied by the number of genres of interest… up against a slowly shrinking group of buyers, the problem is clear. The open minded, smart vendors have been able to let go and transition along with this shift. Those who are unable to accept that the world is changing are missing out by limiting themselves to the same path that they’ve always been on. We all have choices, but this freedom also dictates that we can’t cry about the choices we’ve made. I just think it’s better to be problem solvers.

In a perfect world, everyone would be enjoying comics, but the 80’s are far behind us now. If the business of comics is your livelihood, then being cognizant of the world around you can greatly benefit your bottom line. Proof of this can be seen in those who are actually doing well. However, having said all this, I’ve decided this would be my last ComiCon show. I’ll still be attending, but just not setting up as a vendor. I had a great time but I need to move on and I don’t want to pick up more inventory. Besides, the set up cost is too high and people don’t buy comics anymore 😜

Let’s keep going…

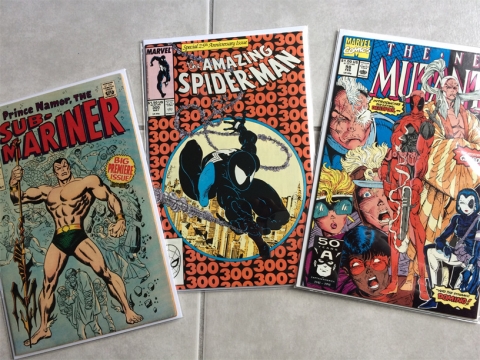

I was itching to pick up a couple of investment books but I just couldn’t find one that offered good value due to the current USD to CAD exchange. I also don’t trust the current political and economic state of affairs, namely Trump, which I’ll elaborate on in a future write up. So, I decided that this is a good time to sell, rather than buy those kinds of investment books. However, I did manage to find a few things I liked and this is my haul from the show:

Just south of me, down at Artist Alley, the painting below caught my attention. For one thing… it’s a fine art piece at a comic show! I stopped to take a closer look and boy, was I ever blown away. Finely detailed…, the technique, the colours and the tone of the painting reminded me of Alex Coville’s work. But not only that… who was this older lady laughing in the middle of a field with space age construction taking place in a rural setting? Clearly there was some deeper thinking applied here. I tend to be socially awkward and I’m always in deep thought so I never know what to say to people, but I managed to have a brief chat with the artist, David Caesar. A Sheridan grad and a comic fan who has chosen to do fine art. As I mentioned, his work is a little derivative of Coville, but I don’t think this is a bad thing since the process of creation is essentially like a forest, where new ideas are sprung from the fertile remains of old growth. Go check out his other works on his website and you can also see glimpses of Bateman and even Christopher Pratt here and there. I mean this as a compliment of course, because this is the level of artistry that is on display here. I think his work is brilliant and I look forward to attending one of his future shows.

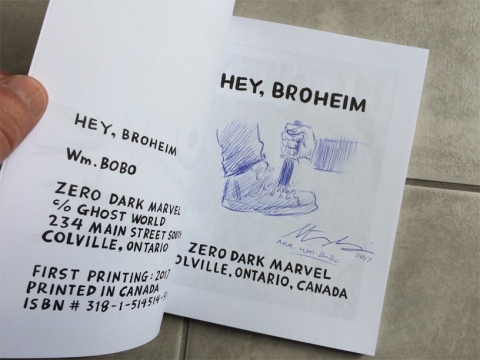

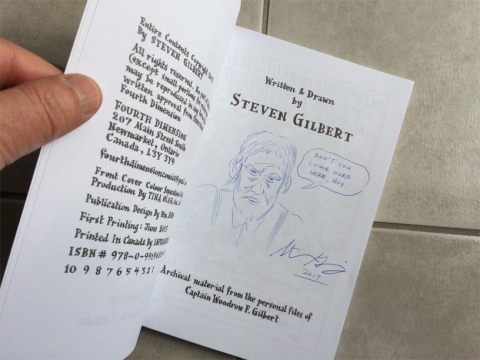

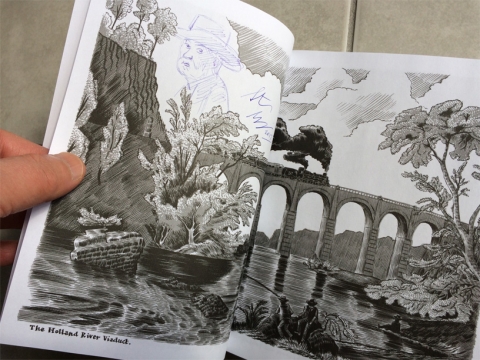

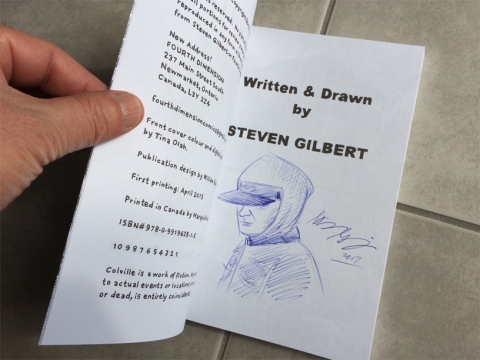

At another part of Artist Alley, I stumbled upon two other creators promoting their books, Salgood Sam and Steven Gilbert. I’m was not familiar with their work but again, I was struck by their individual styles. I liked Salgood’s brush drawings so much that I almost purchased the original art, which was used on the cover of one of his books. I decided that it was cheaper to buy his book instead. Steven had a cross hatching style where the fine line work on his covers reminded me scratch board illustration. He had this crazy idea to re-adapt A History of Violence back into a book, which in turn was an adaptation of John Wagner and Vince Locke’s graphic novel. I can’t wait to get started reading all their works. Both gentlemen were generous with their time and was kind enough to provide a quick sketch in each book I purchased. How great!

Another successful spring exposition has come and gone. Below are some addition images… enjoy the sights and sounds….er, without the sound.

During tear down, I like to imagine that I’m in a video game… as I weave in and out of the aisles, dodging people with my little dolly, trying to make it to the car and back in few a trips as possible. Being a small set up means I’m usually one of the first people out of the loading dock. Cheers everyone.

I was actually enjoying your article UNTIL you got political on me. Here’s a word of advice: Stick to comics.

You mean this single line, that doesn’t go into anything political?

” I also don’t trust the current political and economic state of affairs, namely Trump, which I’ll elaborate on in a future write up.”

Yep, that’s it. And it does most certainly go down that road. Look, I hear political viewpoints all day long, I don’t need to see it here.

That one line was in the article to provide context for why Charlie wasn’t actively pursuing investment books, along with the fact the USD to CAD exchange rate is low, which he mentions in the previous sentence.

This and every article on Comic Book Daily is one person’s opinion on the respective topic. Rarely do we agree completely with anyone’s viewpoint.

You picked up some pick-me-uppers!!!

Uncanny X-men 1966 to 1978 WOW books Romita to Byrne assuming issues 60 to 130 missing key issues. Great investment ! *** Especially any pre #94 issues. Those early x-men even if reprint interiors have awsome covers ! Best books of the 1970s !!! The 1960s books are even better !!! Rare too because title died due to declining sales by #93. An instant collection for sure!!!

Submariner #1 1966 **** great buscema Iconic cover. A rock solid book. Worth it weight in kelp! Nothing wishy-washy there.!!!

Amazing Spidernan #300 ho-hum….not my cup of McFarland…but it is a big round number #300.

New Mutants # 98 yuck…but no fad appeal in that musical chair investment- simply not for me.

If you were itching to pick up a couple of investment books but just couldn’t find one that offered good value due to the current USD to CAD exchange…you hit a homer anyway.

You also don’t trust the current political and economic state of affairs, namely Trump, which you will elaborate on in a future write up. With Trump uncertainty — we cling to nostalgia more.

So, you decided that this is a good time to sell, rather than buy those kinds of investment books. However, you did manage to find a few things. Its always a good time to buy quality.

I think you did well — but dump the new mutants (not Trump) and think golden age-not Eisenhower) Many pre 1950 comics cost less than new mutants and are 1000x as scarce.

I hope you reconsider setting up. Better display. Better selection. Clear pricing. Good lighting. Friendly staff. There is profit to be had is you understand your target customers better. Well, maybe you do. The comics world is not your average normal 3rd planet.

Also i must mention i love your fan boy and girl photos which show why we love the shows so much.

Until the x-men all wear spider-man costumes…signing off for now.

Stevie v.

Great piece Charlie, and I always had you pegged as a Tae-Kwon Do guy.

Steve V. your comments are fast becoming my favorite on the site!!

You’re right: I don’t agree with your defense of his statement. Please stick to comics. Thank you.

AFTA, you may want to skip my next post or two. Policies have a direct impact on the economy, which in turn is reflected in how much disposable income people have for comics. You don’t have to read or agree with anything I say… but I think it’s worth mentioning if it provides guidance for less experienced buyers. Trump’s keystone cops routine is just added comedy which I’ll refrain from piling onto.

Thanks for your comments Steve. I have a varied interest in comics so I’m working on building some runs, picked up some stuff I hope to flip down the road and other stuff I plan to read or simply enjoy looking at because I like the art. My primary reason for setting up the last 2-3 years has been to be rid of material I picked up a few summers ago. I could never sell this stuff online… either it’s too bulky or too cheap that the cost of shipping would negate the effort. If I ever end up with similar material again, I may very well be back on the show floor waving my “big discount” sign.

Walt, your much closer with Tae-Kwon-Do… but I’m lover not a fighter…

Great piece Charlie. It looks like you had a great time and the old gang was there along with some new faces.

I was curious about about your concern with the US Exchange rate, buying at a Canadian show. Were the all of the investment books you were looking to buy priced in US dollars?

Hi Mike, welcome back. I for one have missed you around here. I trust you had a nice vacation.

Most dealers tend convert the value of a book, so that $1000 USD x 1.35 (or whatever the current exchange rate is) becomes $1350 CAD. Guys like Walter and Andy are pretty good about staying close to GPA numbers, but many dealers also like to price books above GPA, so for the same book it could start at $1100 USD x 1.35 becomes $1485. I don’t mind over paying for certain books, and I have in the past for good quality material, but most books I would not touch at that valuation. Perhaps if the exchange was lower, it would help to offset the premium but the exchange is on the high side right now. If the market was strong(er), I might be willing absorb both the exchange and the premium but the current uncertainty gives me pause. Of course, the USD could keep getting stronger, in which case the 1.35 will seem like a bargain, but based on recent history I don’t think it will.

I’m not making any judgements here. I often price my books aggressively as well. Pricing also depends on how much the seller has put into a book, options and availability. As I mentioned before, people who buy at shows tend not to be as online savvy. However, online shopping has it’s own pitfalls so I’ve also met people who refuse to buy or sell online and prefer to deal direct instead. There’s no correct way or one way to make a purchase. At the end of the day, it comes down to choices and whatever works best for you.

Some dealers also like to price their RAW books using GPA, but that’s another can of worms, best left for another write up. The flip side is, many buyers are looking to pay below market price, even for books with lots of built in goodwill, meaning that these books will most likely rise value. So, between the show organizer, the vendors and the buyers… it becomes this dance to see what the market can bear. Fun ^_^

I won’t skip it Chuckie, but with your last statement about the President of the United States, it shows your political standing. Thanks for proving my point.

This was an amazing overview of the Toronto Comicon. I can confirm that Peter is getting married, so everyone should check out allnewcomics.com!

A little piece of advice to AFTA comics. Politics affects our everyday lives, and as Canada’s largest trading partner, US politics affect our lives more than any other nation. Telling someone to leave politics out of things like commentaries on the value of the dollar is insane.

Trump’s current isolationist (see “America first”) policies are keeping our dollar deflated.

Trumps short comings has nothing to do with my political standing, which was never secret. I have no influence and as a Canadian, I don’t even get a vote… so that’s on him. I don’t really care about red or blue so much as individual performance. But this is not a political site so as you’ve said let’s stick to the issues that relate to comics.

Thanks Brian. Politics is definitely polarizing and I’m not judging any particular ideology. However, what’s happening in the US right now is historic. It’s not business as usual, and there will be documentaries and books written about the Trump years. Good or bad, US politics is in uncharted territory and it’s going to have an impact. Just look at stock market surge…

FED policy is more important than the any president these days, and that’s what determines what happens to the economy. Gold doesn’t double every 10 years. “inflation” is a very difficult think to define these days.. CAN$ and Crude oil prices move together.

i miss the conventions of the 80’s and early 90’s. man .. the books that could be had back then .. but, the world has changed. comics business has become more than back issues. comic pricing has become like a penny stock hot potato game, illiquid and all over the place. people seem to ask whatever they feel like. they want to just overprice books to have on their walls and hope someone buys at that price, or at least negotiate to a realistic price. GPA has helped buyers in that respect. having good data to figure out what one should pay. maybe sellers could figure out pricing their books correctly would help them out too..

FED policy is more important than the any president these days

I’m not sure what this means. Is the President not part of the Government? Isn’t his ideas what makes determines policy or changes in policy… at least in part? Sure, he’s not the only member in Government but a new President also signals policy changes.

Gold is often seen as hedge against inflation. Here’s a chart of gold. Depending on which segment of the graph you analyse, overall recent history… it looks like it’s doubling to me:

https://www.bullionvault.com/gold-price-chart.do

Definition of inflation according to Google and the context in which I’m using the term:

a general increase in prices and fall in the purchasing value of money.,/b>

Correctly pricing of comics is all relative. Often, there is goodwill built into quality books. ie; buyers are always wanting to buy books like Hulk#181 cheap or below market. But, you’re never going to find this book cheap due to its strength as an investment. I’ve had to pay a premium for my copies and pay full market or above market depending on the grade.

the president is no longer as important at the FED… when it comes to the ECONOMY. Trump is Irrelevant. we would have had the same outcome in jobs, stocks and inflation had Hilary been elected president. what has mattered was TARP to save the banks, FED asset purchases and interest rates at near 0% for 8 years. Trump, Hilary, Obama, pretty much irrelevant here.

gold is NOT a hedge against inflation, NOR is it MONEY. those are popular misconception perpetuated by the fringe goldbugs. using the price of gold as a determinant for inflation and purchasing power is also incorrect. someone earning $25,000 in 1998 is NOT the same purchasing power as someone earning $100,000 today. your calculations are wrong.

gold prices have fallen since 2011 from $1900 to $1200, does that mean your purchasing power has increased the last 5-6 years? of course not. in 2008, gold finally reached $850/oz, same as in 1980. does that mean your purchasing power for those 28 years was constant? did your purchasing power increase from 1980 to 2000 when gold lost 70% of it’s value? of course not.

“a general increase in prices…” what prices? please define. the price of gold? comics? food? fuel? stock prices? real estate? what? consumer prices? those have averaged 2.14% for the last 20 years in the US and 1.88% in Canada. not the 50% depreciation every 10 years you state.

Hey Nestor,

Thanks for taking an interest in this topic. Knowing that this isn’t a political site, but that the state of the US economy will affect the back issue market, can you attach a link, or point to, or explain what you mean by the following:

the president is no longer as important at the FED

What do you mean by the FED… Federal Reserve? You don’t think the President has any say on how the tax payers money is spent?

Trump is Irrelevant.

Says who? Certainly not the media considering Trump news has been, and continues to be, topical among mainstream media organizations… for over a year now.

we would have had the same outcome in jobs, stocks and inflation had Hilary been elected president.

And yet, the job stat comparison from the end Bush to the end of Obama would seem to suggest otherwise. Please Google it. Also, make sure the unemployment stats do not include those who are retired, students and people who choose not to work for various reason. Those politicians are tricky when citing stats so dig deeper…

what has mattered was TARP to save the banks

Wasn’t it the President who brought TARP into law? It was a way to prop up businesses that should have failed under conditions that they created. Not sure what your point is here.

gold is NOT a hedge against inflation

Many people would disagree. This perspective… thus, not worth pursuing.

NOR is it MONEY

No one said it was money. We are talking about buying power, which is different than money.

using the price of gold as a determinant for inflation and purchasing power is also incorrect

Disagree here as well. It is one of many metrics. Again, perspective. You can take it, or leave it.

someone earning $25,000 in 1998 is NOT the same purchasing power as someone earning $100,000 today. your calculations are wrong.

1970’s – 1 comic book = $0.25

2017 – 1 comic book = $3.99 (or $5.35 CAD + 13% local tax = $6.03 CAD, will vary from city to city, store to store, book to book)

Also, compare prices for homes, soft drinks, food, groceries, fuel… etc. You may want to counter with stuff like cars or computers… but I’m ready for you. If you decide to challenge, please look at commodification, scale and business model before blurting something out.

gold prices have fallen since 2011 from $1900 to $1200, does that mean your purchasing power has increased the last 5-6 years? of course not. in 2008, gold finally reached $850/oz, same as in 1980. does that mean your purchasing power for those 28 years was constant? did your purchasing power increase from 1980 to 2000 when gold lost 70% of it’s value? of course not.

It’s widely believed that the 1980’s spike in gold was due to inflation having reached an all time high. Of course this wasn’t the only reason. High oil prices and the conflict in Iran also instilled fear and prompted investors to move their money into precious metals. In 1981, the government made a commitment to reduce high inflation and gold normalized soon after.

The same can be said in 2008, as various factors (including the housing crisis) caused investors to move into gold in a big way. According to the various index’s, inflation peaked at 4% in 2011 as the US started printing more paper money. Then, global inflation began falling causing gold to fall 28% in 2013, or it could be viewed as normalizing again.

As you see, high inflation caused by uncertainty devalues money so people start moving into gold. When the economy is more stable, people move into equities… or in my case comics. How you interpret these gyrations is up to you but clearly inflation IS a factor. Based on recent history, wealth seems better served in gold as opposed cash just sitting in your bank account. Will this continue? Will it always be this way? Does history ever repeat itself? Who knows… However, don’t just look at stats on gold. The point I’m making above is that the middle class is under pressure and there is less disposable. You can cross reference this against salaries, debt, buying habits… you name it, because it all points in the same direction.

“a general increase in prices…” what prices? please define. the price of gold? comics? food? fuel? stock prices? real estate? what? consumer prices? those have averaged 2.14% for the last 20 years in the US and 1.88% in Canada. not the 50% depreciation every 10 years you state.

I’ve already stated several items. 1.88% in Canada? Increase? Per year? Please clarify what you’re referring to here, as well as your source.

Thanks Nestor.

This is Charlie’ s post. I see Charlie’s point that Trump creates uncertainty for many people, and some of those guys will hold off 2017 investing in comics.

NESTOR says. …… Trump is Irrelevant. we would have had the same with Hillary.

Maybe so, but investments are driven by fears and perceptions, only occasionaly by such sound logic. But actually Nestor makes a valid point.

I remember in 1986 there was a mini recession, and comics did exceptionally well. I think in hard times, people turn for comfort and escape to nostalgia. Some people take a personal stand that Trump cannot pevent them from enjoying their hobby, so retreat from the problems of uncertain times into collectables.

CHARLIE says. The point I’m making above is that the middle class is under pressure and there is less disposable income — it all points in the same direction.

As Charlie says, many people lack funds to invest in comics. As Nestor says, the world goes on.

What Charlie is not fully taking into account is auction prices are higher than ever. Record prices are being set for both comics and original art. That is an un-denayable fact.

If you invest in stocks, you have paper. It may go up or down. Noone knows the future. If you invest in comics or art, you can look at and enjoy it regardless whether it goes up or down.

So here are the top 10 investment books for 2017 and my evaluation their predicted 3 1/2 year return (maturing at December 31 2020):

1. Hulk #181 in 9.8 or better with no coupon clipped. 500%

2. Amazing Fantasy 15. (Spiderman) in 8.5 or better. 400%

3. Strange Tales 110 in 9.6 or better. 350%

4. Detective #38 1949 first Robin complete any grade. 300%

5. Hulk #1 in 6.0 or better. 250%

7. Action #7 in any complete grade. 200 %

6. Avengers # 1 in 9.4 or better. 150 %

8. Pep # 22 in 5.0 or better. 100 % .

9. Journey into mystery #83 in 9.4 or better 100%

10. Action Comics #1 1938 in any grade. 100%

Some bold investors will reap these returns.

Fear and uncertainty for other will hold them out of the comics market. Many people lack funds to invest in comics. It takes money to make money. It takes courage to invest when others are hiding their head under sand, or hiding behind a Trump wall. Time will tell. 2020 vision from the year 2020 is perfect! In 2020, we will say “if we only had a time machine” to come back and buy these books in 2017.

Regards….Stevie V.

I remember in 1986 there was a mini recession, and comics did exceptionally well. I think in hard times, people turn for comfort and escape to nostalgia. Some people take a personal stand that Trump cannot pevent them from enjoying their hobby, so retreat from the problems of uncertain times into collectables.

As you say… it was a MINI recession and the 80’s were the heyday of comics. People were actually still collecting back then and had more buying power. The 80’s were boom times, not just for comics, but the overall economy. The middle class was not under pressure as they are today.

So, when life gets difficult… people read comics? Where did you get this info? What about people who don’t like comics… Yes, they do exist.

What Charlie is not fully taking into account is auction prices are higher than ever. Record prices are being set for both comics and original art. That is an un-denayable fact.

This is misleading of course. Funny how the same people who talk up “record prices” never ever mention “record lows” on a particular book or grade. By your logic, I guess this means “record lows” don’t exist? Ahhh… marketing… it still works.

But seriously, for those of you who are awake… the current market is a spec market. I don’t know what this means down the road, but it differs greatly from the 80’s boom.

If you invest in stocks, you have paper. It may go up or down. Noone knows the future. If you invest in comics or art, you can look at and enjoy it regardless whether it goes up or down.

Last I checked… comics were also made of paper. CGC books can’t be read but I can download the cover and stare at it for free. Perhaps if you’re a billionaire, you don’t care if you make or loose $100k on a book. But the average sane person would cry if they lost their $100k investment, whether be it in stocks, gold or comics.

As I always say… the money has to come from somewhere. Walls don’t build themselves… Thanks Steve.

I’m sorry… but this is such TRUMP logic and my mind is blown:

As Charlie says, many people lack funds to invest in comics. As Nestor says, the world goes on.

What Charlie is not fully taking into account is auction prices are higher than ever. Record prices are being set for both comics and original art. That is an un-denayable fact.

• Trump is rich, he doesn’t have financial pressures… so neither does anyone else? Really?

• Record comic prices are being set… so people don’t have financial pressures? Really?

What do record comic prices have to do with social and economic reality? You can’t point your finger at Trump for living in a bubble, from within a bubble of your own. Let’s be real here…

This blog should be about reading and prices of comics, not Peter Parkers struggle to buy medicine for Aunt May.

CHARLIE SAYS… So, when life gets difficult… people read comics? Where did you get this info? What about people who don’t like comics…

I know guys who overcame depression turning to superhero comics for internal strength and inspiration. Of course, its not for everyone.

CHARLIE SAYS… People who talk up “record prices” never ever mention “record lows” on a particular book or grade. By your logic, I guess this means “record lows” don’t exist?

Prices are rising as a trend. Look at an old price guide. Yes some go down too, but would you really invest in books setting record lows like modern age foil glitter muliple covers. Paper is fragile and holds up poorly to floods, and fire and become scarcer yearly. Actually i hope Amazing Fantasy 15 falls to $500 each and i would buy them all…..and resell them when prices recover back to $5,000. But prices on quality collectables never seem to go down.

CHARLIE SAYS… comics were also made of paper. CGC books can’t be read but I can download the cover and stare at it for free.

You can read a book and look at the cover you own, or hang original comic art on a wall or show to other collectors.. A stock or bond seems less satisfying to look at.

CHARLIE SAYS… if you’re a billionaire, you don’t care if you make or loose $100k on a book. But the average sane person would cry if they lost money.

With risk comes reward. Comic books have been a solid investment for 50 years plus with golden age most atable and most risk on newer books.

CHARLIE SAYS… What do record comic prices have to do with social and economic reality? You can’t point your finger at Trump for living in a bubble.

Any level of investment can occur in comic. A billionare can invest ten million dollars in mile highs and original art covers. A poor guy in Italy can spend his liras or euros on coverless or reading copies. Both investments can double in value if made wisely.

Rich do not live in a bubble like Louis XIV and Marie Antionette in the 1812 french revolution of “let them eat cake”. In 2017 Billionares are very in touch with social media and everyone interacts as an equal online.

Comics are for everyone who enjoys reading them. The love of comics is universal among collectors and unites rich and poor in common interest and love of, and appreciation for, the same mythology. The positive messages in comics of heros for good over evil, struggling to overcome adversity, and stories with a positive moral message educate as well as enrich.

But, if you want to be cynical about the whole comic book industry, you can find greed and jealosy. Remember the book — seduction of the innocent. You can throw away your childish books and toys. My point is that hose who do so often wish they had kept their comics, when they see prices 10 years later.

Stevie V.

I know guys who overcame depression turning to superhero comics for internal strength and inspiration. Of course, its not for everyone.

We’re talking general public, not individual.

Prices are rising as a trend…. But prices on quality collectables never seem to go down.

Only for certain books… and as long as there are buyers are around. Also, these same books can break new lows. Whether they should is another story but a bad auction result does happen from time to time.

A stock or bond seems less satisfying to look at.

Subjective. Not relevant.

Comic books have been a solid investment for 50 years plus with golden age most atable and most risk on newer books.

So have stocks… with bouts of bad financial climate, as well as other forms of collectibles, such as coins and notes, rare stamps, memorabilia… etc. Like I said, as long as there are buyers willing to pay for this stuff. What makes comics so special beyond personal interest? This isn’t a competition. Comics can be good, but so can other forms of investment or entertainment. However, it’s all fun and games till someone looses their shirt.

Any level of investment can occur in comic. A billionare can invest ten million dollars in mile highs and original art covers. A poor guy in Italy can spend his liras or euros on coverless or reading copies. Both investments can double in value if made wisely.

Yes, but your original comment put record prices (as an undeniable fact) against people who can’t afford to spend much at shows. Record prices do not negate the pressures that low income households face. There’s no correlation here.

In 2017 Billionares are very in touch with social media and everyone interacts as an equal online.

Are you nuts? Again, talking groups, not individual… what do you think all the hoopla around occupy Wall Street has been about? Have you been listening to hypocritical, tone deaf comments made by politicians (from both the left and right)? Have you even heard the dumb ass responses during the vetting of people like Besty Devos and Rex Tillerson and soon to be confirmed Gorsuch? What planet are you typing from? These people are soooo out of touch it’s unbearable. Devos, who has never spent a day in public school basically wants to privatize education. In other words, only those who can afford it are allowed to learn, perpetuating a cycle of hopelessness for the poor. Education is potentially the one equalizer that these people have… *** peace, love… harmony… ummmm*** Okay… I’m calm.

But, if you want to be cynical about the whole comic book industry

This is not about cynicism. This is about living in the real world. Everything I’ve stated can be verified. If you’ve read any of my post regarding investments, then you know my write-ups are geared toward helping those who are less experienced. I take comic investing seriously, which is why I bring up real world issues such as political, social, economic and entertainment trends in order to get at the truth and take a close look at factors that can affect our small market. Stuff Overstreet, auction houses and the comic media at large rarely ever talk about real stuff. And on the rare occasion they do, it’s almost always never objective. For example; record prices.

Thanks Steve. I think I’m done with this topic. I appreciate your thoughts but I just don’t drink the kool-aid. I prefer to keep it real and favour more substantive discussions. I’m happy to be a cheerleader for comics but for me, it has to be rooted in fact, like the FF#1 started the Marvel Universe. From there we can begin to make connections and theorize… but without this critical thinking, it’s all just gibberish.

Let’s follow up on your predictions 3-4 years from now. I couldn’t help notice that FF#1 was not on your list… is this a veiled dance challenge? Wow… Hulk#181 soon to be a $100k book? I can’t wait!

“Knowing that this isn’t a political site” -> yes. but you brought up politics and economics into the topic.

FED = Federal Reserve, yes. Trump is completely irrelevant. He did not create the current economic environment, did not create the current 200,000+ jobs /month the US is seeing, nor the 4.7% unemployment rate, nor the 2%+ GDP growth. this was the FED, keeping interest rates at 0% for 8 years, increasing their balance sheet to $4.5 Trillion and getting US banks back on track.

GOLD = FEAR and is not a hedge against inflation nor is it a way to measure inflation. those that think so are the fringe lunatic gold bugs that have been saying this for the last 50 years, who claim the world will end and you should own gold. GOLD = FEAR nothing more. Warren Buffett seems to agree.

INFLATION is tracked by the BUREAU of LABOR STATISTICS (BLS) in the US and by STATISTICS CANADA in Canada. it’s something called the CONSUMER PRICE INDEX. it measures a basket of every day items most canadians and american purchase in day to day life. there are hundreds of items tracked over decades. in CANADA, the average inflation rate for the last 20 years is 1.88%, in the US it’s 2.14%. this data is published MONTHLY. maybe you’ve heard of it?

your statement that gold doubles every 10 years, and so, purchasing power is halved every 10 years is false.

you may have an axe to grind about Trump. i personally don’t watch TV, nor do i read crap in the news. he got elected. he’s the president. and from what i’ve seen of his policies, tax cuts, infrastructure spending, deregulation, trade reform.. , these are all VERY POSITIVE for the US economy. so, sorry to be upbeat, when you’re so glum. but there is NO uncertainly regarding Trump. it’s just a matter of how strong the US economy is going to be in the next few years. probably far better than the lunatic gold bugs believe, or the left wing media turkeys.

Steve V. : i much prefer stock/futures to comics as investments. so much easier. comics are pretty and nostalgic. can be a very fun hobby. i have a decent sized collection. some nice books. i will occasionally buy something “interesting”, but i personally won’t put serious money into comics, unless it’s totally disposable. the cost of doing business when all factors are considered in comics is just too high to make money efficiently.

Government issues bonds through the Treasury.

Treasury passes those bonds to the banks, who sells them to Fed Rsv.

Fed Rsv. writes cheques to bank, bank gives money to Treasury.

Then the money is spent on social programs, public works, war… etc.

It’s a fractional reserve system, which many people recognize as a pyramid structure. The more money that is issued, the more it devalues currency through inflation, which is what happened during housing crisis. While it’s true that the Fed Rsv is technically an independent company with stake holders, and it has its own set of powers, but in reality decision are made in cooperation with the government.

Are you saying that Trump specifically is not relevant or Presidents in general? Trump just got into office, so he inherited 8 years of growth. Lets see what happens after 4 years as he funnels more money into the military, blows $20+B on a wall, all the while cutting social programs. Are these decision not made by the President and his cabinet? What is it that I’m missing? If you’re a Trump fan, that’s fine. That’s opinion and you’re welcome to it.

Okay… lets go with your number:

1.88% inflation per year x 20 years = 37.6% less buying power.

1.88% inflation per year x 30 years = 56.4% less buying power.

Here’s an inflation calculator from the Bank of Canada… one of many online. Have fun:

http://www.bankofcanada.ca/rates/related/inflation-calculator/

Clearly, uncertainty and inflation factors into the pricing of gold. The term “hedge” in financial terms IS a safety net… just in case… Yes, from FEAR of loss. Is it a measure of inflation? No… not exactly since other factors also influence gold and inflation independantely. The doubling of gold was only in reference to recent history, which I found interesting because it seem to correspond to inflationary rates. I don’t own gold and I really don’t have any interest in gold so I’m happy to get off this topic. Believe what you will but the people of Greece would have been much better off if they held gold… or a Hulk#181.

Thanks Nestor.

i’m sorry. but you don’t seem to be making things up now.

correction…. you seem to be making things up now… so.. sorry.

I’ve cut this paragraph from your last statement and filed it so that we can revisit it in the coming years:

you may have an axe to grind about Trump. i personally don’t watch TV, nor do i read crap in the news. he got elected. he’s the president. and from what i’ve seen of his policies, tax cuts, infrastructure spending, deregulation, trade reform.. , these are all VERY POSITIVE for the US economy. so, sorry to be upbeat, when you’re so glum. but there is NO uncertainly regarding Trump. it’s just a matter of how strong the US economy is going to be in the next few years. probably far better than the lunatic gold bugs believe, or the left wing media turkeys.

Personally, I find it very confusing. If what you mean is that Presidents are not relevant… then how do you explain the economic contrast between the Clinton years vs the Bush era? If you’re talking about Trump specifically… I don’t understand why you believe his policies would have a POSITIVE effect on the US economy. I mean, is he relevant or isn’t he? If you don’t read or watch the news, where are you getting your info from? I don’t disparage your beliefs… I’m just trying to follow your train of thought.

Thanks again.

Nester and Charlie should text each other on the economy. Charlie can propound Occupy Wall Street and anti Trump ideology. Nester can reply with a conservative and establishment position. But this is a post about comic books.

I know someone who bought a CGC 3.5 amazing fantasy #15 about 6 years ago for $4,000 in auction and recently was offered $20,000 minus 10% commission. That 400% return over 6 years is 65% yearly return

I know someone who bought a Jack Kirby. Dick Ayers original Fantastic Four page for $1,600 in 2005 and recently was offered $35,000. by a dealer for it. Thats 2200% return over 12 years or 150% return per annum.

Nester might rather buy futures, and would necessarily pay captal gains on stocks.

Charlie would not invest at all .

Did Fantastic Four #1 start the Marvel Universe? That is debatable. We do not need to accept that fact before we begin to discuss comic books. Without Fantastic Four #1, we can still begin to make connections and theorize with critical thinking.

In 1958 Marvel laid off 90% of its staff. Books were not selling. Star marvel artist Joe Meneely died taking a train to new york. In 1960 a recession hit the USA. But with Brave and Bold #28, DC comic sales suddenly rebounded. Julius Swartz told Stan Lee’s uncle Martin Goodman while boasting in a golf game and Stan was told to produce a super hero group. Nellie the Night Nurse with cancellation became fantastic four. Marvel had only 8 titles of distributor space so printed 60,000 copies for back issue sales. Back issues sales were born!

The best selling comic of 1962 was Amazing Fantasy 15!

There was no big bang…just a Timely response to Justice league success!

Stevie V.

Stevie, i love paying capital gains. means i’m making lots of money. and would love to carry on the conversation in private, but Mr. Charlie can’t figure out how to use an inflation calculator, so, there’s no wonder he’s confused with everything else.

Flattery will get you nowhere Nestor. One of the corner stones of this blog is to share information. If you feel my math wrong, I would love an explanation. Not necessarily for my benefit, but perhaps it could be helpful to someone else.

Hey Steve, try asking what Nestor he thinks about comics as an investment… I’ve already been down that road with him.

good lord help me, they don’t teach math in schools any more ?

A = P ( 1+r ) ^ t

A = future value

P = present value

r = interest rate

t = years

1.88% over 20 years

A = (1.0188) ^20

$100,000 today is equivalent to $68,900 20 years ago.

the average rate of inflation over the last 30 years is not 1.88% its higher. i stated the rate for the last 20 years. maybe try using the calculator. it’s not that hard.

“I know someone who bought a CGC 3.5 amazing fantasy #15 about 6 years ago for $4,000 in auction and recently was offered $20,000 minus 10% commission. That 400% return over 6 years is 65% yearly return”

try not to believe everything people tell you. GPA shows the last sale for a 3.5 AF15 is $12500. the average for the last year is $13250. nobody is going to pay your friend $20,000 for that book. even if it WERE true, his return is 350% (assuming he gets $18,000, and assuming he paid $4000, and assuming it’s 6 years ago) his annual rate of return is 20%, NOT 65%

“… original Fantastic Four page for $1,600 in 2005 and recently was offered $35,000. by a dealer for it. Thats 2200% return over 12 years or 150% return per annum.”

let’s “assume” this is true, since i don’t believe the first story. it’s actually a 2090% total return, but a 29% annual return, NOT 150%

you see Charlie, when you trade stocks and futures, numbers are important. maybe not so much in the comic world…..

clarification,

his annual rate of return is 20%, NOT 65%… (at current market prices $13,000)

30% rate of return, at the imaginary price of $20,000

So according Nestor, after an average inflationary rate of 1.88% over the past 20 years, we have 31.1% less buying power… NOT 37.6%. My God, how could I have been so wrong? And here I thought I was making a point about our devalued dollar… but lucky for me I had Nestor to point out my error.

Thank you very much Nestor for such a meaningful contribution. I feel 6.5% richer already.

try and keep things in order Charlie, your original statement declares money devalues at 50% every 10 years. i know it’s hard to try and remember these things. wholeheartedly a false statement…

” Gold appears to double every 10 years, but it’s actually money being devalued by 50%, which is basically what inflation is. ”

the fact you can’t calculate, nor do you KNOW how to calculate inflation over a period of time is another issue altogether…

“By my calculation, if you have an annual salary of $100k, at the current rate of inflation or devaluation, your $100k has the buying power of about $25k to $30k from our parents era, which is not a lot of leverage. ”

and in fact, i’m actually shocked that you make these comparisons. do you not get a cost of living increase every year at your job? or are you making the same wage today as you were 20 years ago? maybe you’re in the wrong industry? i get a raise every year in addition to a cost of living adjustment. maybe .. you should look for different work?

almost as troubling is the fact you have no understanding how the bond market works:

“Government issues bonds through the Treasury. Treasury passes those bonds to the banks, who sells them to Fed Rsv. Fed Rsv. writes cheques to bank, bank gives money to Treasury. Then the money is spent on social programs, public works, war… etc.”

as well as displaying a serious lack of understanding of what happened during the financial crisis. the housing crisis happened because of “inflation” ? seriously? are you joking?

“The more money that is issued, the more it devalues currency through inflation, which is what happened during housing crisis.”

thanks again for coming out. i can’t wait for your next article. ciao

Nestor, we continue to face all kinds of social issues, environmental challenges and a broken political system… but your busy picking crab grass in your backyard.

We’re all thrilled to hear you’re well compensated for inflation but you may want pop your head out the window and take a look at the rest of the world. Maybe your particular math equations are better than other metrics, such as gold or what can be directly observed, but either way, you miss the big picture. Also, you may want to re-read what I wrote because, not only are you missing the point, your read is inaccurate. Your too busy pointing out how stupid I am that you fail to show us how smart you are.

Here are some stats you can browse and see if it aligns with your academic approach. If you don’t like these particular stats, you can search up others… to which I’m sure you’ll cry propaganda:

http://stateofworkingamerica.org/

If you ever decide to step out of the weeds, maybe then you’ll realize that the world isn’t limited to your own reach.

Enough.