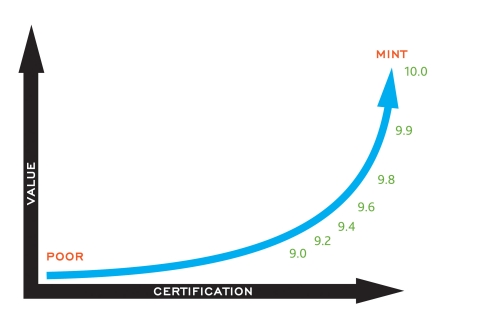

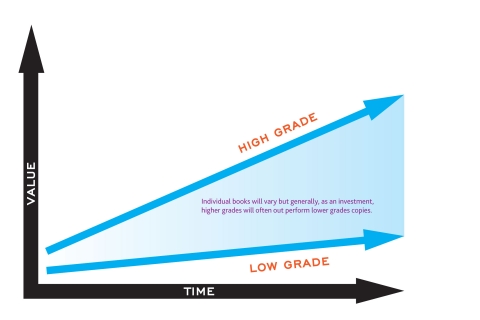

When it comes to investment comics, here’s what we know: The growth trajectory isn’t a simple ramp but rather an exponential curve and higher grades can offer higher yields.

Serious hardcore comic investors like to dabble in high grade books that can range from $20,000 to $300,000. I’m sure most of these buyers and sellers are well off and can afford to play the game but many are just like you and me; an average person with an average income who have what most people don’t have; initiative. Most of these sales are private but based on past sales figures we can see how a $20,000 investment in a book like Fantastic Four #52, 9.8 can net out at over a 400% increase in just a few years.

“Yeah… but that’s just because of the Black Panther movie…”

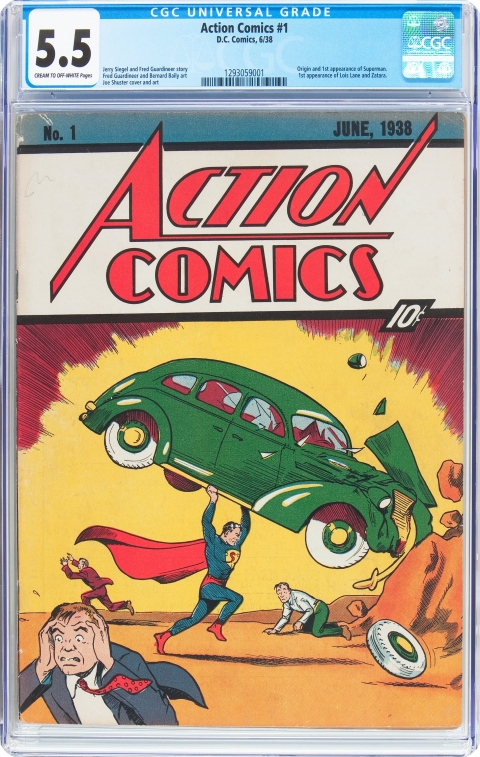

Or how about the recent Action Comics #1, 5.5 that’s been making news lately. Originally purchased for $26,000 sometime in the 1990’s and sold for whopping $956,000 on Heritage Auctions recently.

“But that’s a major grail… and there’s precedence.”

Maybe so, but a quick scan of past sales shows some equally astounding results:

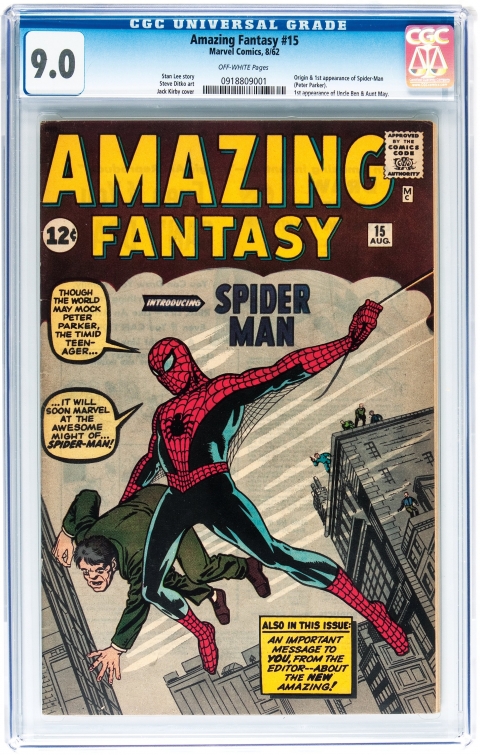

Amazing Fantasy #15, CGC 9.0

2002 – $26,881

2016 – $66,995

Avengers #1, CGC 9.0

2004 – $5,700

2015 – $27,250

Fantastic Four #1, CGC 8.0

2001 – $12,650

2016 – $31,070

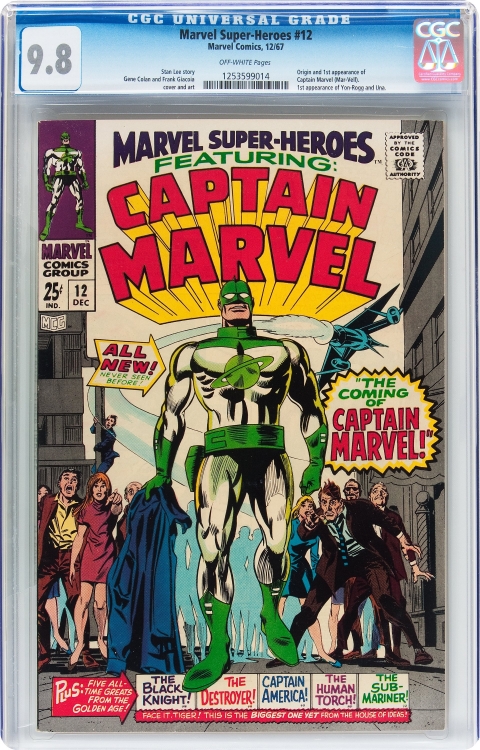

Marvel Super-Heroes #12, CGC 9.8

2004 – $1,375 to $2,314

2016 – $6,250 to $7,170

Yes… I’m being selective with my picks here in order to demonstrate what could happen. Many high end books actually remain flat and some even decline. However, the data is limited and thus misleading either way. Sales records have been better in recent years but they don’t identify who, how and where the books were sold. As well, during a span of 10 to 15 years, trends in the economy and in culture will be big factors that influence the market. However, if you play the speculative game and you watch the market close enough, anecdotally you may conclude, as I have, that most high end investment books do very well. The few that have gone down tend to be from auctions and even here, there seems to be a limit to how low they go.

So, does this mean that I’m recommending you remortgage your house and pick up high grade copies of Amazing Fantasy #15, Avengers #1 or Fantastic Four #1? Definitely NOT… because, comics are actually not rare. They are rare only at certain grades, which is what makes the value ramp curl up at high grades. Also, what the data does not show is who is buying and selling these books. With only a few copies of, say a 9.4 of a particular “key” book in existence, many of these are being passed back and forth among a small group of affluent collectors and dealers. Record breaking sales are then hyped up by trade media, which in turn helps to promote the next sale. We’re still in anecdotal territory here so if you want to dispute this, I won’t argue with you. However, based on what I’ve read and discussed, this seems to be the case. All markets have their quirks and to some degree it makes sense because people are lead by their interests and we will naturally speak highly about the things we like. Any community bound by a common passion will always seem odd from the outside and some actions may appear questionable despite being unintentional. However, the real question I’d like to get to is…

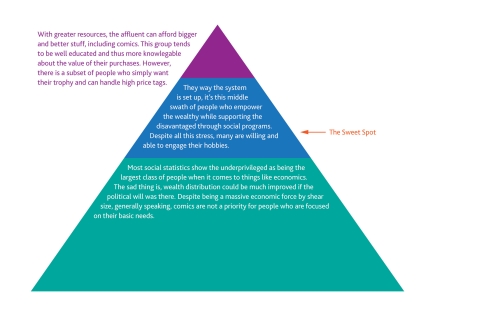

Is there an ideal grade that we should focus on for maximum profit? Is there a “sweet spot”?

In order to answer this, we have to look at how we are going to SELL our potential investment. Before buying any book, I highly recommend that you formulate some sort of exit strategy. Higher grade books may bring in higher profits, but I personally don’t know anyone who is willing to spend $100k on a comic book. Still, these books exist and there are many people who are engaged in this activity at a very high level. I don’t personally know these people and I don’t associate with these people so spending $100k on a comic book is not an option for me, even if I could afford it. Based on my current means, my train of thought when purchasing a book flows something like this:

• How big is the comic community?

• Within this community, how many are investors?

• Among the investors, how many would be interested in this particular book?

• Out of these interested people, how many can afford it?

While it’s true we all want the best books, this doesn’t mean that we are all willing to pay the price. As such, in order to reduce risk and maximize sales I look for the “sweet spot”. The “sweet spot” is the ideal grade of a book that is high enough to be coveted but low enough to be affordable by the largest group of collectors. While it’s true I can always use forums like Heritage Auctions to auction off a high grade book, I’m not willing to risk being part of that under performing stat. If the average combined household income is about $70k per year, you can imagine the stress upon that household, which is very different than a household where the $70k is being earned by a single breadwinner, typically the male. Better yet are the unmarried males, yes males, who are earning $70k or more because this means they have more time, and more resources they can apply to hobbies or investments. As such, the buyers that I seek are not necessarily the affluent but rather large groups of people who are willing.

What all this translates to are investment books valued at about $2k to $3k, possibly up to $5k depending on the book. Yes, I can consolidate ten $2k books and buy one $20k book but without that network of high end buyers, I have to consider what people around me are willing and able to afford. Often, my exit strategy involves eBay. Although big ticket items do sell on eBay, liquidity is a key component to my sell strategy since I can’t afford to have large sums of money tied up indefinitely. So the “sweet spot”, in terms of the grade, will vary according to the book and it’s age, but for me it is what the largest group of collectors can afford… the very best $2k to $5k book that money can buy.

We all have our individual circumstances and we all have varying degrees of risk tolerance so it would be silly to think that there is a universal answer to optimizing an investment purchase. However, while there is no one comic or one grade that fits the bill, we can still make efforts to protect ourselves and leverage our understanding to get the most out of our efforts. The purpose of this write up is to provide some food for thought from an investment standpoint, but let us not forget what brought us to this hobby and remember to also have fun.

The best investment out there right now is a 6.0 – 8.0 Daredevil #1. Bar none! ‘Nuff said!

Hey Charlie,

I finally stopped drooling at the these books on your post. Awesome grouping.

I don’t know if it is a sweet spot or not, but I have noticed a lot of higher costing books from the Silver/Bronze Age are getting full guide or better in the lower grades. The books you posted would fit in to that category. Silver Surfer #1 & 4, Green Lantern #76, Incredible Hulk 181 and others. I think this comes from collectors who are giving up grade for a book they can afford for their collection. The $1000 mark is a bit of a mental/ financial barrier for many collectors..

I do like your investment group in the $2K – $5K range as the type of books to invest and “play the game” for a real return. I am a total dollars return person in terms of investments, and I don’t get hung up on percentages. I can’t spend them ^-^!.

I agree with your thinking on the sweet spot Charlie.$2k-$3K books are more in line with what a larger group of collectors can afford and the books you pointed out were great examples!That was a great looking copy of FF#1 8.0!I would like to see that in my collection!

I’m with you guys on that under $5K (more like $1-$3K) range as the sweet spot, be it high grade books that are top dollar at that grade, or affordable copies of keys that are out of reach in high grade for all but the whales.

I’ll go 90% of the way with Jack on mid-high DD#1 being a great play, and maybe I’ve been reading too much Walt (hah! No such thing!) but FF#1 even in mid-grade is a screaming bargain now, and the majority of the census copies are below mid-grade.

I also think there’s good deals with room among Golden Age books, but when it comes to silver with room to run, I keep coming back to DD#1, FF #1, Adventure #247 and FF#5 every time I scan the Overstreet top 50. Did I miss any other blue chipper that can emerge from the middle of the top 50 SA pack?

I have to disagree with you about the Adventure 247, readcomix. I’ve never met a collector who wanted to shell out $20k on a near mint copy of 247, even if Mon El will be in the Supergirl tv show. It’s historically significant, like GL 76, but I don’t think 247’s actually sell at Overstreet Guide prices.

I feel that Silver Age DC books that have room to run are Batman 171 (1st silver age Riddler), Flash 105 (even though it’s already expensive), and some of the less expensive Showcase books. On the Marvel side, not many key books that would be considered affordable or even cheap. But I agree that DD#1 has room to run – a near mint DD #1 is still around 10k in the Overstreet Guide, but in the real world, it’s selling for well above Guide value.

Peter, I’ve been back and forth on Adventure #247 but more forth lately. I’ve never met a fellow collector with $20K in hand for many particular books either, but I don’t quite see it as narrowly historically significant like GL #76. The Legion, like Daredevil, has enjoyed over the years periods of significant popularity and time off the radar as well. It’s one of the those concepts that seems as a good a bet as any to have another popular incarnation down the road. What’s not speculation is the supply side. Early silver DCkeys in general are tough in grade, but this one seems to be about the hardest, other than Detective #225. Ebay auctions have had plenty of bidders, with rough raw copies going for below assumed Guide grade, but there’s a recent 6.0 sale on Comic Link around $6K. A grand a point, above Guide, in mid-grade. On the other hand, not too long ago, a 9.0 on Heritage went for just over $11K.

I may be wrong but when I look at the Overstreet top 50 SA books and ask myself what on that list has the ability to vault up into the second tier (just below the big four of AF 15, Hulk 1, FF1 and Showcase 4) as Avengers #1, Astonish #27 and B&B #28 have done in recent years, the only plausible candidate I can find (it is a gamble, but that’s part of books we perceive as undervalued, no?) is #247, due to scarcity, especially in grade, and potential for the property to see a creative resurgence.

Then again, maybe my thinking is falsely reinforced because I’ve been unsuccessful this year in multiple efforts to land one. I got copies of Madhouse #22 and Astonish #27 more easily earlier this year.

I agree about Showcase too; gems in there for sure. Heck, I think I counted 18 issues of Showcase with a higher guide value than #34! I would add Flash #123 to your DC list too; I think it is to DC as Avengers #4 is to Marvel.

I think there’s also SA Marvel books with room to run, albeit outside the top 50. This is the part where everyone knows I’m going to bring up Amazing Adventures #1, but I also like to varying degrees FF#4, Strange Tales #135 and Strange Tales annual #2.

Which Showcase books do you like? Do you agree on #34?

Hey Charlie,

Instead on giving my 2 cents on specific books, I just want to commend the article. You are addressing what Walt (and to a lesser extent, I) try to feel out in the market. Well worded, straightforward and calculated article. There isn’t an exact science but rather a calculated art to a proper speculation of comic investing. Well done, and looking forward to chatting at some of the upcoming fall cons if you should attend!

Hi readcomix, thanks for mentioning Strange Tales #135, it has good upside as it is the first time we see Nick Fury as a SHIELD agent and it’s still a cheap SA Marvel key. In addition to FF#4, I also like Journey Into Mystery #85 as a good long term investment. Besides being the first Loki issue, JIM #85 gives us the Asgardian universe, including Odin, Heimdall, Bifrost bridge, etc., so even if fans lose interest in Loki, this book will always be important for bringing Asgard into the Marvel universe.

On the DC side, I was thinking mainly of Showcase #30 (first Aquaman try-out and also 1st appearance of Aqualad) as being a good bet, but Showcase #34 (first appearance of the Atom) is also a solid choice. Brave and the Bold 54 (1st Teen Titans) is another one that can move up in value as more Teen Titans characters could cross over into DC Universe movies. Yes, I agree with you about Flash #123. It’s always popular and it bridges the Golden Age to the Silver Age just as Avengers #4 does for Marvel.

Gents, sorry for being tardy but I just got back from a family camping trip… Speaking of “undervalued”, why aren’t more people longing for Northern Ontario. Probably the best lake system in the world… it’s beautiful up there.

The emotional component to collecting/investing dictates that we all have our favourite books that we like to root for, which is great. But I also like to encourage people to be more objective when the purpose is to come out ahead so that we don’t get burned by our personal biases. That is, it’s always nice to own high grade “keys” that we can brag and show off but liquidity is a huge part of what I buy.

DD#1 is a hot book these days and I’ve bought and sold dozens over the years. But being a newer SA key, high end, hard core collectors don’t seem to respect it as much as the 1963 books. Still, it’s a moot point where the greater collecting community is concern and appears cheap next to similar grades of TOS#39, FF#1 or JIM#83.

I like the Legion but was never a fan of Adventure #247. I always viewed the Legion as a campy concept and didn’t think there would be big demand for this book. When I got stuck with a nice looking 5.0 in trade deal I wanted to get rid of it. I shopped it around and it sold quickly. Then I did a bit of research, yes after the fact, and the impression I got was that nice looking, affordable copies were hard to come by. Many old time collectors seem to be holding this book and don’t want to part with it. I still feel the audience is limited, but I concluded the books were as well. One of the few books I regret selling… I should have held out for more!! ^_^

Thanks Shekky. Indeed, many hard core collectors on the CGC boards will have differing views. Many of them like to deal in big books but again, it comes down to the network that you’re able to link into. I like to think that I represent the much larger swath of “struggling to make ends meet” CGC buyers and sellers.

Thanks all for your comments! As the superhero movie biz matures, it’ll be interesting to see how it affects the spec community.

some books show good returns (Avengers 1, Marvel Super Heroes 12), the others are ho-hum average. are those prices/results after fees to the auction house/ebay? what is the net profit for the investor on the 4 big books listed? the owner of the Action #1 which sold for $950K gets what?

comics are a fun hobby,… but i’m sure people don’t own 5-10 big books, hoping they will outperform the market.. more likely, they own a whole bunch of books which a lot of money was invested, and will never be sold at anywhere near what was paid or owner “thinks” the books are worth.

Hi Nestor, GPA numbers are before commission, of course. We don’t know how and where they sold so we wont know the net, but at minimum it’s probably less 10%. Still, as Bob Storm says, it still represents what the buyer was willing to pay and ultimately helps to define a books value.

While we’re on the subject of fees, I wanna take this opportunity to mention that my overall monthly eBay fees are about 12%. Although eBay takes 9-10% for final value fee, I’ve got 2-3 pages of ongoing listings. Each listing costs about 30¢ US per month which makes eBay’s take higher than what most people think. Add to that about 3% from PayPal and the overall cost of selling through eBay is actually 15%, which is hefty for an automated system. Not to mention they make money from us Canadians by offering us the worst exchange rate… ever, which the local banks have now adopted.

Collector and investor are 2 sides of the same coin. I do know a couple of people who hold only a small number of books for the sake of investing but most of us arrive at investing through the joy and the fun of reading and collecting. I’m sure even high end collectors and dealers still hold a box or two of worthless books simply because they are attached to them. So it’s not one or the other but a matter of degrees based on personal interest and circumstance.

As long as the buyers are willing to “buy”, comics will be always be “worth” something. It’s when the buyers will eventually disappear that concerns me. Considering I started buying comics when they were 25¢, believe me, I’ve already gotten it all back in multiples… and rolled it back into more comics. However, there’s no value in this kind of thinking since that was a long time ago and the idea is to look forward. There’s no way to properly factor in stuff like inflation or could’a, would’a, should’a. Like any other industry, there are people who have made millions through comics and lots of people who have chosen to make “buying and selling” their career.

Thanks for chiming in.

those are extremely high transaction costs.

When I was a little boy, my family made the decision to move to Canada. With nothing but the shirts on our back, we ran across the rice field as we heard the sound of rifle fire in the distant. We kept running toward a deserted pier and hid behind cargo boxes as we waited for a guy named Muk Cho to take us to a creaky rusted boat where we would stand for the next nine days as the boat rocked back and forth. Luckily, we were packed in there like sardines so that all 43 of us could support each other. I could seem my mother braced up against a fat shirtless guy so I knew she could not fall even if she wanted to. After nine days, the door suddenly opened and we saw sunlight. We were then ushered into a factory building where we sat in the dark for long hours before being separated and taken to a private room where a strange white male would speak, and an interpreter would translate… “Little boy, why do you want to live in Canada?”

I was nervous so I simply told the truth. “Because in Canada people are free…”

At this moment, I open up the one sack I was carrying and showed the strange white man my Hulk #181. He looked down at me and gave me a deep understanding look. I smiled back at him knowing that from this day on, I would be able to exercise free choice and choose to pay a third party business for their help in selling my Hulk #181 or I could choose to sell it on my own and keep 100% of the proceeds.

Nestor… that was over 40 years ago and I’m happy to report that nothing has changed.

that’s a very touching story Charlie. ever watch the movie “sin nombre”? that’s what my wife’s relatives had to do to get to this country. or, i could tell you about a civil war that pitted brother against brother, one facist, one socialist. or i could tell you about how the nazi came to my parents village and routinely used to take the men and beat them then shoot them, i’m sure there are a lot of stories people can tell.

but really, what’s that got to do with transaction costs on comic book?

Simply that in Canada, you are free to pay a fee for using a service or you can do all the leg work yourself and pay nothing. The best way to complain about high transaction costs is to simply not to transact through a third party service.

Hey guys,

Two points: 1) An apology — I should back up and say to Charlie that this is my favorite post in a while. Thanks Shekky for politely calling me out as I took us on a tangent by going too granular and discussing “prime candidate” books that might fit the “below $2K to $3K investment” bill. That’s of course the final question as a collector but in between is everything Charlie’s post brings up, the ways of assessing the sweet spot. I guess the more germaine question in my mind than “which books?” is actually what about lower grades of the biggest key books? They do seem highly liquid, but if I park say $5,000 in a less than 2.0 Amazing Fantasy #15 (plug in any low grade key that will still cost at least $2K; just an example to clarify the general question) am I still making an investment with significant upside or just buying a comic book equivalent of a savings bond? And either way, when do the rest of us collectors (other than the market-defining whales) figure out that many mid-grade keys may be undervalued by the very decisions we are making? In other words, if a given SA key, for example, is fairly plentiful but apparently scarce at about 6.0 and above, do those mid-grade copies hold more potential upside than highly liquid low-grade copies or fairly high-grade (less than 9.8) copies of the best Bronze keys? I think Charlie’s post goes to thinking about all these types of questions.

2) I have no experience with CGC boards and want to ask about it, so I’m going to post that question in the old “Where to Sell” post if anyone is kind enough to share experiences. Thanks!

In a previous post, I recommended that investors consolidate their low grade books and not be afraid to pick up higher grade versions which would bring in higher yield. In this post, I suggest that investors do the opposite and break up a $20k book into 10 x $2k books. Perhaps you’re all to polite to call me on this seemingly contradictory recommendation but I am, of course talking about extremes.

Many low grade books of big keys are very flat today by the shear abundance of low grade books like X#94 or even the might FF#48 that are available. It’s my belief that at this time, books valued at about $2k to $5k seem to rise enough and be liquid enough to be worth flipping. This spread may change as the market continues to rise and inflation (or deflation) takes an effect…

Where SA keys are concerned, normally I like to hit the 4.0-6.0 range. In the case of books like AF#15 or a Hulk#1, the 4.0-6.0 has now risen beyond my reach and the reach of most collectors I would say. Yes, we all want one but most are not willing to put so much money into one books. I regret selling my Hulk#1, especially since it really took off after my sale. My current copies of SA books are all below $5k. Books like X#1 or Av#1 in the 4.0-6.0 can still be had at the “sweet spot”. I suggest you pick these up quick, along with DD#1 which appears cheap compared to the 1963 set. My FF#1 is a just under certified 3.5 but looks nicer than my previous 3.5, and I recently sold my JIM#83, 4.0 for $3500, which I miss but it just wasn’t moving fast enough for me to keep that money tied up, but that’s another discussion.

I’m sick of the CGC boards. I need a break from all that cynicism. If those guys were actually as smart as they think they are (or as ethical), they wouldn’t be spending so my time there. Haven’t been on the boards all summer… much.

Thanks Charlie! I for one don’t think you contradicted yourself; as you said, extremes (and different circumstances, which cannot be ignored as ours is a hobby of niches and sub-niches, in many ways). Heck, I think you just identified a pretty good buying opportunity rule in your reply to me: If a major SA key is available between 4.0-6.0 in the $2-$5k range, the buy merits serious consideration. (This probably can apply to the biggest 10 of Marvel’s dirty dozen as DD #1 and Sgt Fury #1 can be had in better grade for the middle to top of that $$ range — probably also not bad ideas, but a different discussion than the “affordable upside” discussion of the other major keys.) I have to think harder about DC or GA of any sort and price/grade sweet spot. But I will be scanning various sites’ sold listings for major mid-grade keys and corresponding sales in the few thousand $$ range!

Charlie, I think I was too vague on the CGC boards question — any change of opinion about selling on there since your “Where to Sell” column? I haven’t tried and am wondering about whether its worth a shot.

The attraction of the CGC boards, of course, is that there are no fees involved. Being peer to peer means it requires lots of trust, and as such it’s self policed by a small group of long time posters that come off as being a clique who are quick to jump on errors made by newcomers.

Still, it’s a good place to sell, and a great place to buy! Most board members are speculators and dealers so they are always on the hunt for under priced books. However, for top dollar when selling, I still prefer eBay. Board members are quite knowledgeable and the name of the game is to catch a book below market price. Because of this, it’s a better place to buy as many sellers will discount their book since they are not being charged a fee. Sometimes the books are so cheap that I’ve picked up keys and flipped them as soon as I received them.

GPA is the law on the CGC boards when it comes to prices but this can often work to your advantage. Generally speaking, GPA is historical, even if the last price is only a week old and does not reflect what people are actually asking or what is available. If GPA averages $1000 for a book but the ask everywhere else is $2000. I’d say use GPA as leverage to negotiate a better price and try to pick up the book at $1000 and relist at $1500. If everyone is asking $2000… at $1500, your book will be the cheapest and will be the next one to sell.

I look for low hanging fruit so I have no preference where I pick them up. But I still prefer eBay when it comes to selling, despite the 15% chop. However, this year has been slow so I’m resisting the urge to pick up all the great deals out there. The world is in a slump so I’m waiting for some signs of improvement.

Thanks Charlie! Sounds like those boards are trustworthy within reason if one establishes oneself and lurks and learns for a while first. I thought it might be a good place to sell more esoteric books but of course you get the masses at ebay too so maybe its not necessary.

5