In my last post I looked at the incredible decline in market values for several key Marvel Bronze Age titles over the last couple years. Among the reasons for the decline of this group is the number of high grade raw titles that have been slabbed and stamped with a 9.8 grade over the last few years. For example, over the last few years, the number of 9.8 copies of X-Men #94 recorded on the CGC Census has increased to 11 from 3.

This week I want to examine how the census numbers influence the market values between the 9.0 – 9.8 grades (i.e., the “mint” grades). Immediately we’re confronted with three problems. The first is a lack of data. To really make any statistically significant conclusions more data is needed. For example, for Incredible Hulk #181 I only have six transactions recorded. One of the transactions is from 2003. Another is from early 2009—right before the bubble popped. The second problem is that the data is constantly changing; the census data is fluctuating with new additions and market values have gone nowhere but down. Lastly, there is no agreed upon definition of market value. Here I define market value as the median of the last eight transactions. For grades where I cannot find eight transactions (such as Incredible Hulk #181 9.8 where I have just six) I use the outstanding data combined with my own judgement.

With these problems understood, let’s move on to the analysis! I chose the following titles for this article: Amazing Spider-Man #129, Amazing Spider-Man #252, Amazing Spider-Man #298, Amazing Spider-Man #300, Fantastic Four #48, Daredevil #168, Giant-Size X-Men #1, Incredible Hulk #181, New Mutants #87, New Mutants #98, Punisher Limited #1, Secret Wars #8, Uncanny X-Men #266, Wolverine Limited #1, and Wolverine Vol 2 #1. This group represents heavily traded titles (so we get lots of transaction data) and a mix of Silver, Bronze, Copper, and Modern Age titles.

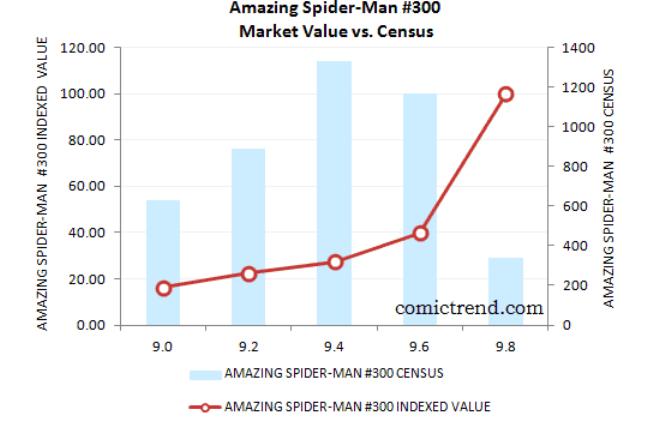

How does the census data look for a typical title? Below are charts that present the census data and market values for Amazing Spider-Man #300 and New Mutants #98. On the primary y-axis is the census number for each grade. As expected, the 9.8 grade for Amazing Spider-Man #300 has the lowest count. The highest count belongs to the 9.6 grade. For New Mutants #98 the census data is completely different. There are almost just as many 9.8 slabs as there are 9.6 slabs. The decline in the census is quite steep below the 9.6 grade. However, we can’t say there are really fewer 9.4 issues than 9.6 issues as there are obviously more of these lower grade issues “out there” in the world for both titles. It’s just that they remain ungraded as the cost of CGC grading and the potential return from a higher grade slab motivates the submission of near mint/near mint+ titles. This is especially true for New Mutants #98—a 9.8 copy only goes for around $200.

On the secondary y-axis, the 9.8 market values are indexed to $560 and $195 for Amazing Spider-Man #300 and New Mutants #98, respectively. So the 9.8 value equals $100 and the values for the 9.0 – 9.6 grades are presented as percentages of $560 and $195. For Amazing Spider-Man #300, the 9.6 grade’s market value is about 40% of the 9.8 grade’s value. This compares to 50% for New Mutants #98.

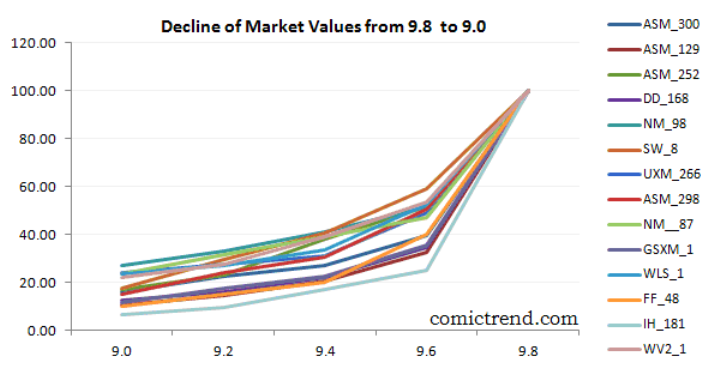

Plotting all the indexed market values of all the titles in the group we get the following chart:

Plotting all the indexed market values of all the titles in the group we get the following chart:

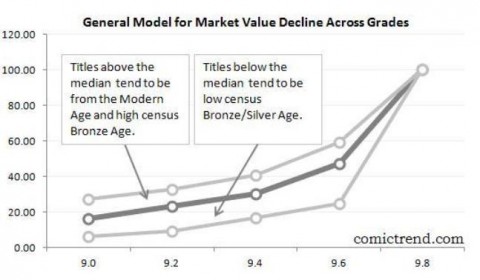

Using this data, a general model can be created. For the Modern Age titles, where the number of titles across the grades is very high—and potential supply from ungraded issues is a real threat to graded supply—prices do not fall as steeply as the tightly supplied Bronze Age and Silver Age titles. For example, one of the steepest declines occurs with Incredible Hulk #181. For this title, the number of 9.8 issues in the census represents just 4% of the total 9.0+ supply. Secret Wars #8 resides above the median with 47% of the 9.0+ supply represented by the 9.8 grade. Pricing tends to be much flatter for titles where the 9.8 grade represents more than 20% of the total 9.0+ supply. In fact, all the titles below the median have less than 20% of the total 9.0+ supply allocated to the 9.8 grade.

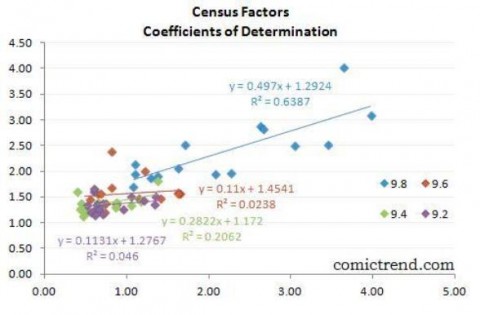

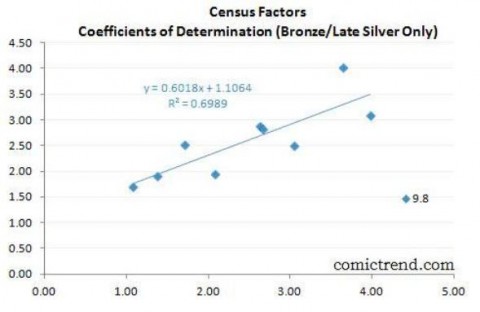

So how much does the census data between the grades impact pricing? One approach is to find the coefficient of determination, or R2, between the census data and market values. This is just a fancy way of saying that what we really want to know is how much the census data accounts for the variability in market values across the different grades. The census data is the independent variable and the market price data is the dependent variable. If the census data does play a role, then we’ll see a positive relationship (i.e., the bigger the difference between census data between the grades, the bigger the difference between market values) and a R2 value that suggests a good portion of the market value variability is indeed explained by the census data.

For the independent census variable, I’ve created what I call the “census factor,” defined as the lower grade census/higher grade census. Next I’ve created a “price factor” which is the higher grade market value/lower grade market value. The chart below presents the relationships between the 9.8-9.6 grades, 9.6-9.4 grades, 9.4-9.2 grades, and the 9.2-9.0 grades. Immediately we can clearly see there is a positive relationship between market value and census data between the 9.8-9.6 grades. The R2 is a strong 64%, which means the census data accounts for 64% of the market value bump between the 9.8 and 9.6 grades (even higher at 70% for just the Bronze/Silver Age titles). Although we have limited data, it’s safe to say that we can conclude the census data plays a big part in explaining the price difference between the two grades. This confirms the generally accepted view, and it’s great we finally have some data to back it up!

The next conclusion from the chart is perhaps a bit more unexpected: the census data has VERY LITTLE to do with the market value differences between the grades! In fact, the census data is basically irrelevant! It’s best to just follow the general model developed above to model the price differences between the grades. It appears the collecting community establishes the 9.8 market value based on the census data (by comparing it to the 9.6 census and the outstanding census data for all the 9.0+ grades) and then just slashes the market values below the 9.8 grade according to the general model: 9.6 value = approx 50% of the 9.8 value, 9.4 = 30% of the 9.8 value, 9.2 = 24% of the 9.8 value, and 9.0 = 16% of the 9.8 value. Then an adjustment is made for the total supply (high for Modern Age, low for Bronze/Silver). Of course there are many other variables at play including the popularity of the book, historical significance of the book, and other factors that influence collector demand. That being said, this model is a great starting point for understanding the market dynamic.

The equation next to the linear trend lines shows the parameter vector and error term. So if you ever find yourself bargaining for a 9.8 title on eBay or at your local comic shop, all you have to do is find the 9.6 census data, multiply it by 0.50, add 1.29, then multiply this number against the market value of the 9.6 grade to arrive at the theoretical value of the 9.8 grade! See, comic collecting is easy!

OK, so you’ll never do that. But hopefully this quick look into census data and market values helps you understand the relationship between them a bit better.

Wow… that is IMPRESSIVE!

Your explanation of exponential curves is very interesting… In my biz we call that irrational exuberance or in this case, depression. Because of my advertising/branding background, I tend to view things more from an anthropological perspective and my assessment is that what you are saying is compounded by a lack of demand. Simply, there are less buyers these days.

I’m curious… where do you see the market 10, 20 and 30 years from now? I’m predicting (or rather hoping) that the curve is parabolic… but as you’ve mentioned, the lack of data or history makes things difficult predict.

Hi Charlie,

Thanks!

I have NO clue where the market is going… it just depends on so many factors. One thing I know is that there will ALWAYS be demand for key Silver, Bronze, and Modern Age titles. Even as new titles switch to digital format, there will always be collectors out there for the key titles. Comics, and the characters introduced in key issues, still have a huge place in pop culture.

The problem is that the demand for comics could come from an increasingly small group. High grade CGC collecting now is made up of a pretty hardcore group but I fear this group can only get smaller as the number of new buyers slows and the old buyers leave the market and retire from the business. Fortunately, the supply of high grade comics should start to taper off. But it still is increasing (and now pressing is throwing a wrench into things), further pressuring the market.

On the other hand, there could be a huge resurgance in comic collecting. The conversion to digital may broaden the total audience. This bigger audience may desire to seek out the old, original historical books.

So, basically I have no idea! 🙂

Very interesting. Two things. First, in the very long term, will the difference between a 9.0 and a 9.8 really stay connected to an 84% price differential? Will anyone in 30 years really care about what are ultimately small differences in grade on anything but the most desirable items? What happened with other collectibles like stamps or bank notes that have been around for longer (or fine art prints)? Second, there is a HUGE potential to mass-market comic grading, by persuading the many people who buy old comics online that getting comics graded is a safer way to buy and sell, and by opening up grading to a more international market. The prices for grading would have to be lower, but I’m sure this would be attractive to a lot of people in a lot of countries.

Good news. Let’s keep the ball rolling; particularly by NOT BUYING anything printed after 1980 in a CGC slab.

Srew,

Great questions. Perhaps many collectors don’t really care about 9.0 vs. 9.8. If you’re a fan of a character or a comic book then getting your hands on a nice 9.0 may suffice (9.0 is still a great grade!). However, the grade does matter to a lot of people. It might only matter just because it’s in a little box on the top right of the slab. But if the price of X is A then X + higher grade will ALWAYS be A+B. Perhaps the differential will narrow over time. We’re really working with insufficient data. Even though slabbing has been around for 10 years now, it’s still a very, very young market.

Great points about stamps and bank notes. I don’t know enough about those. Definitely worth looking into!

As the great art and cultural institutiona of the world seek their treasures at the greatest Auction

Houses,it will be for the rarest comics and the ones

which are harder and harder to find. They will not

give a rats ass regarding a Spidy 129 in 9.8!!

This is in reference to Stephen B Keisman’s comment. I believe there will tons of collectors wanting the asm 129 in 9.8. The Punisher is a marvel mainstay and this guy’s comments are absolutely absurd and comes from someone of low intelligence.

Hey R.J. – Last year I needed to clear some space in my basement and sold 9 boxes of modern comics to a 28 year old man. He said that he never reads the comics. A few days ago, I bought a silver/bronze collection of about 150 comics from a 23 year old college student. I suspect that a growing number of new buyers of all ages will invest comics that they can afford, particularly in the Silver and Bronze Ages. The continuing onslaught of high budget super hero movies is driving up pop culture interest. The general awareness that vintage comics can be a good investment will drive movie and pop culture fans to buying comics for fun and investment. Many of these new people (many young) may or may not actually read the comics. But they like the idea of it of the look of the old art and having a piece of these vintage collectibles that inspired the movies they love. I suspect the number of interested buyers will grow. I see the economy as the biggest threat. If the middle class keeps disappearing, their interest won’t matter if they don’t have money to invest.

I just wanted to add that for years Overseas purchases have been reducing comic book inventory in the U.S. This factor may not yet have made much of an impact on available Bronze Age inventory, but for those in it for the long term, this diminishing supply and continuing pop culture interest, could see the Bronze Age values climb back to their highs several years from now.

There is obviously a huge difference between even a 9.8 and 9.9. Perhaps the difference isn’t represented entirely by the physical condition of the comic book, but it is definitely represented by the amount of money people are willing to pay for it. For example, a 9.8 walking dead is selling on eBay for e approximately $1,500 as opposed to a 9.9 that sold for $10,000! Physically, there is not a huge difference between a 9.8 and 9.9, but there is a huge difference in the rarity of a 9.9.

i dont know why anyone (except someone with literally money to burn) would pay extra for a .2 difference in a grade (over 9.0 obviously) when that .2 difference comes down to the opinion of a few people that varies from book to book and day to day…

sidenote: am i correct in my assumption that a silver age 7.5 looks way better than a current 7.5? that alone skews the system enough that comparing 2 current books (lets say a 1985 book even) that are 9.4 vs 9.6 becomes moot. and pointless. there are too many grade levels!