Summer is well underway and I’ve spent the better part of this month fixing little things around the house. Next on the list is to give our deck a fresh coat of paint. I saved the old paint can so that I can get the store to match the same colour. I remember paying about $27 for one standard can of paint just over 5 years ago, but I was shocked to find out that a new, fresh can of paint is now almost $50 after taxes… for the exact same brand, same colour and from the same store. Yes, almost double the cost! Good old inflation rearing it’s ugly head again. Keep this in mind as we discuss comics…

In part one of market watch, I revisited 3 concerns I had…

1. 2016 holiday sales. Very similar to 2015 holiday sales… 2016 was relatively flat despite a slight uptick in the GDP.

2. US policies. Comics are an American product and the biggest pool of buyers are in the US. I’ve got a bit of money tied up in comics so when US policy makers talk, I listen.

3. Movie fatigue. I’ve decide my concern here is unwarranted. Most people are sheep, including myself, and need mindless distractions. If the simple premise of robots with guns has propelled the Transformers franchise to move forward with a loosely planned schedule of about 14 films, there is no reason why even bad comic book movies couldn’t also do the same. I’ve had to remind myself that art and commerce are two separate things. While it is possible for whole genres to fall out of favour with the movie going audience, the interconnected storylines and modern special effects sets the comic book movies apart from westerns, martial arts or rom-coms. Also, it’s an international market these days, so movies that are easy to understand overseas and are entertaining, like the Transformers franchise, will probably continue to be profitable.

So, how have these factors influenced the comic market… if at all? Let me get to the punch and say that not much has changed from this time last year. You can stop reading right here and save some time… or we can delve a little deeper. As I mentioned in part 1, it’s all a matter of perspective…

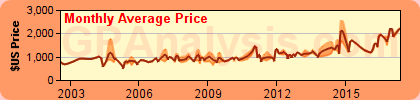

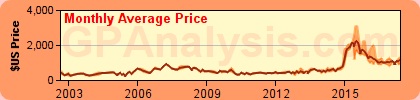

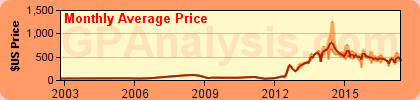

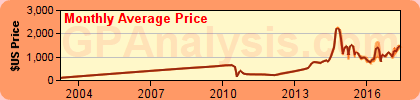

One of the reasons I like doing these writeups is to try and gain a bird’s eye view of the market. It’s my way of trying to determine what is normal in our area of interest. This is important because it helps to establish a benchmark, which we can use to gauge the investment viability of our books. It facilitates better decision making during ongoing changes in the greater economic, social and political spheres of influence. For example, why did the market suddenly surge in 2012? Why did it stall in 2016? The CGC market is relatively new and with so many external factors to consider… I’m not actually convinced that a “norm” can be established, but we share our knowledge and thoughts so that we can continue to move forward. Let’s break it down…

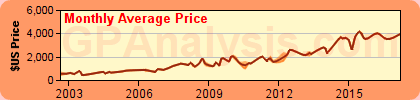

Silver Age – It should come as no surprise that Silver Age books have been very stable. Not all the books are rising as fast as they have been during recent years, but they are rising. You’ll see the odd decline once in a while, depending on the grade, probably due to an off auction, but overall “key” books from this era continue to perform well and are worth hanging on to.

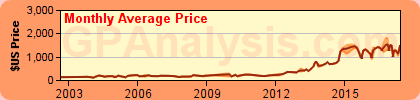

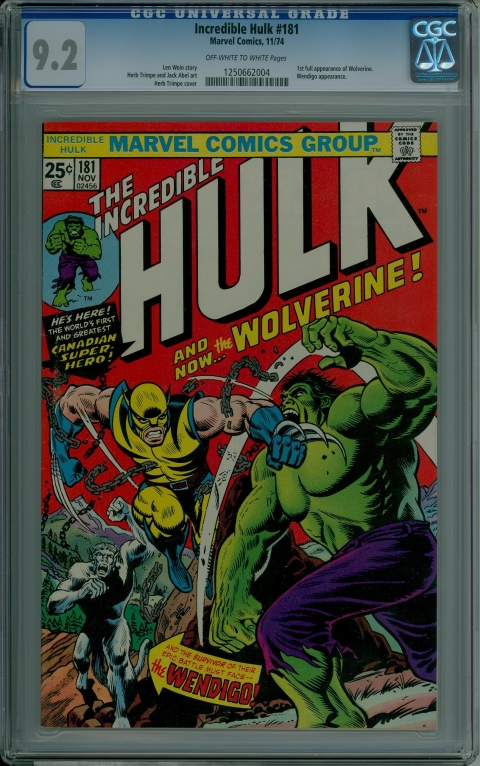

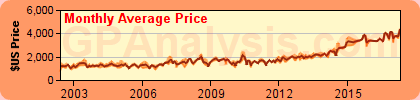

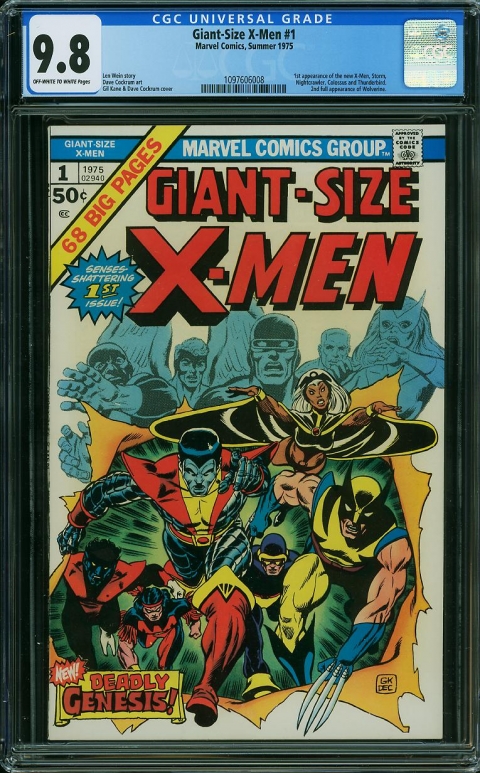

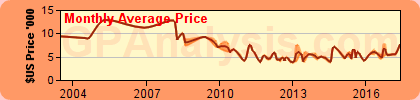

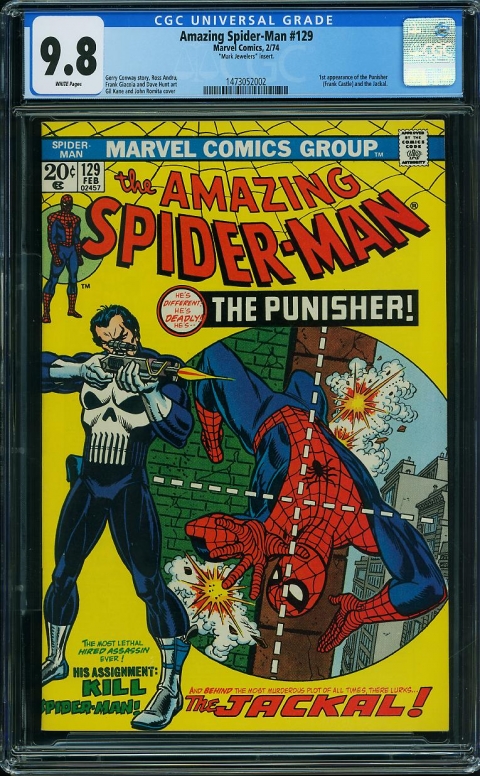

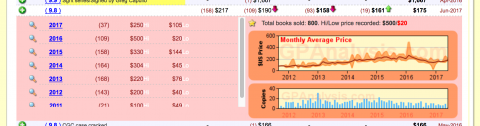

Bronze Age – “Key” books from this category are also doing well and may eventually become the new Silver Age of tomorrow as I see more and more investment buyers interested in this particular era. These buyers tend to be slightly younger than I am so it makes sense that they feel more connected to this particular age of books. The Bronze Age quadfecta have yet to reach their pre-2008 highs at the top grade, and probably never will until the effects of inflation kicks in over time, which to me suggests that books like Hulk #181 and X-Men #94 should never have been flying high at $25,000 to $30,000 to begin with. Amazing Spider-Man #129 may be the exception here as it closes in on its previous high with several recent sales in the $10k range… So, if you’re that one guy who paid $14k back in 2008, you may be on the verge of breaking even. The only problem is that these books are not rare and tend to be plentiful in high grade. The census continues to erode value as more and more high grade copies are made available, especially when they can be manufactured by pressing lesser books. Eventually, press-able books will dissipate but it’s hard to say when or how many more books are left to increase the census numbers. Still, all this is relative to demand so the values should hold as long as the interest is there.

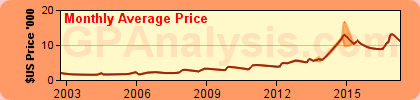

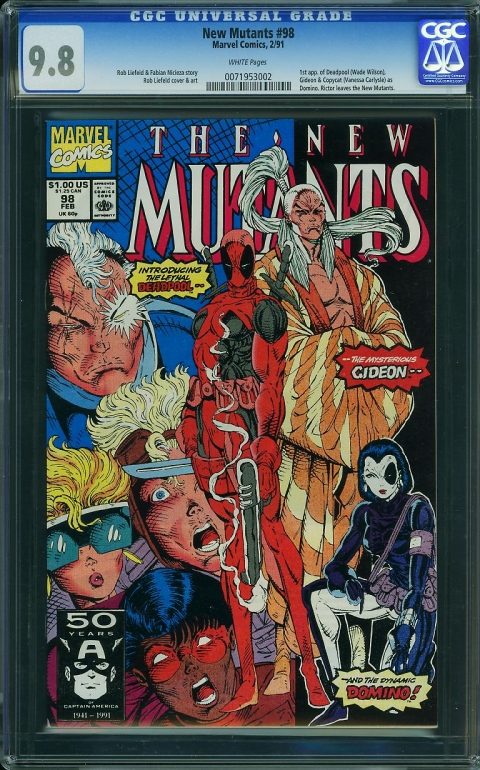

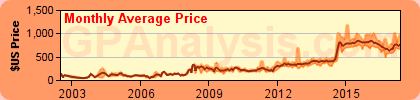

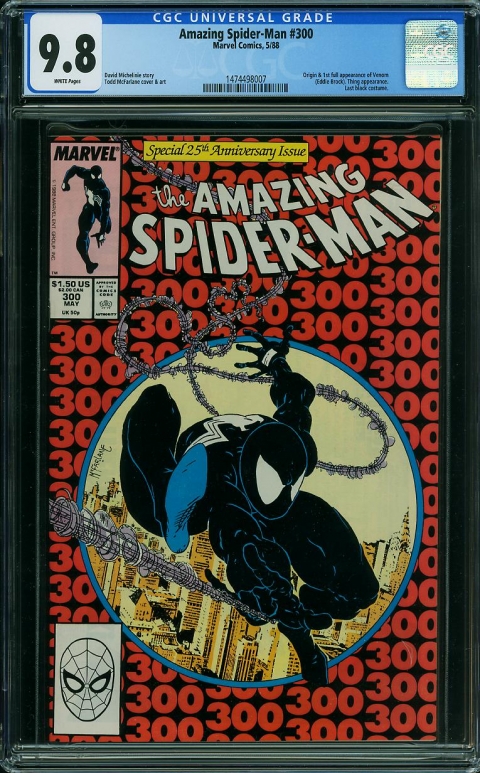

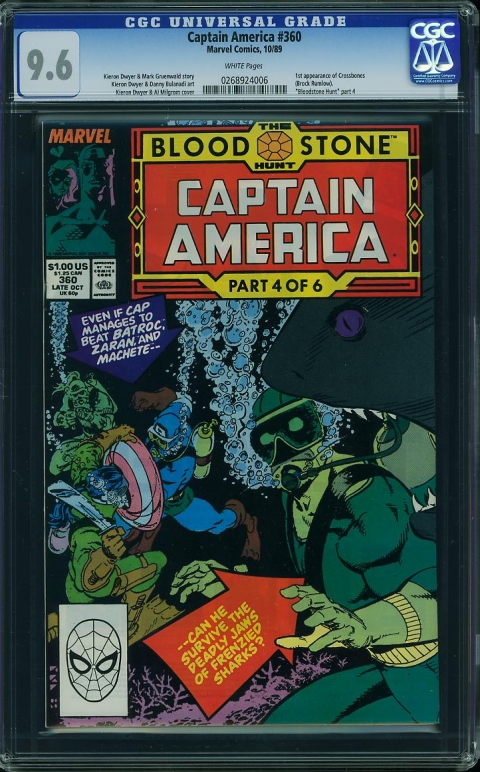

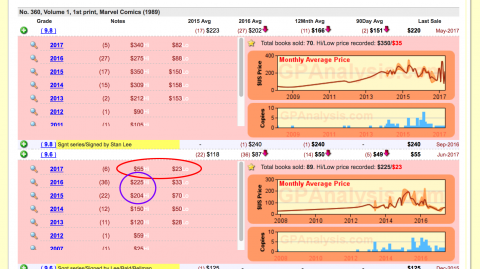

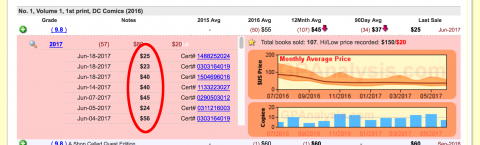

Modern Age – As you can imagine, the Modern Age tends to be the most volatile, but also the most fertile in terms of characters or undiscovered books. Similar to penny stocks, they have greater potential for return (by scale). But for now, almost every “key” book I looked up is off its peak. But, there is good news for people holding slabs like New Mutants #98 or Batman Adventures #12, which is that there are more movies coming down the pipe. The trick here is to buy only high grades… 9.8’s, 9.6’s… or bust, and never buy these at their highest point. For example, Amazing Spider-Man #300’s have recently shot up in value. If you’re one of the 889 people who are holding 9.8’s, or one of the 2527 people holding 9.6’s or 2749 people holding 9.4’s, congratulations. But if you’re not, and are tempted to make a purchase now due to the Venom hype, know that you’ll be paying the highest price this book has ever been. Yes, the book can and probably will climb even higher but if you’ve never been interested enough to make a purchase at its pre-hype price, there’s even less reason to be interested in it now. I’m not a fortune teller, but I think the play here is to wait it out, and revisit your buying premise once the dust settles and it’s “true” value is revealed.

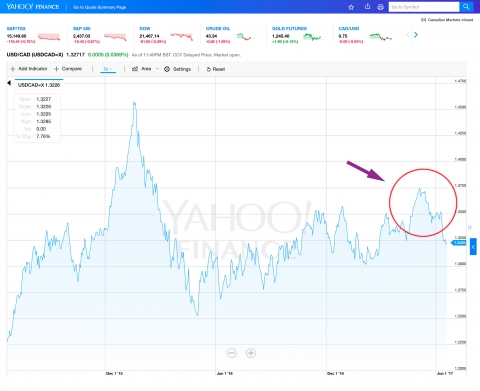

So in general, the good news is that “key” books are doing well. “Keys” that appeared to go flat are showing signs of improvement since my last report back in 2016, while the popular titles are doing exceptionally well, reaching record prices with each new sale. This has prompted me to start selling my inventory of Giant-Size X-Men #1’s, Hulk #181’s and Amazing Spider-Man #129’s and I’m happy to report that I have been receiving top dollar for these books. But the current high valuation is not the only reason I’ve tapped into my vault. Most of these books were purchased a decade ago during the housing crisis when I was more active with buying. So, the question I’ve had to ask myself is, do I really believe that these books will double, triple or quadruple again in the next 5-10 years? Perhaps some books will, but the overarching answer for me was no. I just can’t see Amazing Spider-Man #129, 9.8’s selling for $20+k anytime soon. Not with the current US political uncertainty, not with the overall market slowdown. But there’s more… Canadians also have one eye on the exchange rate and the recent conversion has been very favourable with the US dollar recently pegged at the second highest point against the Canadian dollar since 2004. As well, I generally don’t like to hold books above $2k (depending on the book). But why sell Giant-Size X-Men #1’s, Hulk #181’s and Amazing Spider-Man #129’s specifically…?

The bad news is that it’s ONLY the “keys” that have been moving, and so I’ve had no choice but to tap into my reserve. Perhaps the market read my write up about choosing “quality-keys” over “junk-keys”… because never has this been more true than it is now. “Semi-keys” remain flat and all other “junk-keys” or “non-keys” have been tough to sell unless you’re willing to offer a hefty discount. The problem of course is that there are less collectors, more speculators and in the case of newer books… waaaay too many available. Go to any show and practically every table with have an X-Factor #24 for sale. My sense is that buyers are being more selective about their purchases, which is a good thing. Buyers are not picking up just any old book, simply because it’s graded or because it’s cheap, nor should they. Also, low ending auctions and desperate sellers are skewing the numbers and bringing down some averages. When you see auctions end in the $20 to $30 range for books that used to sell for over $200 at one point, one could argue that it’s better to hold until the book’s value goes up again, or at least until it’s able to cover the cost of grading… But, the flip side to this equation is… TIME. Who knows when, if or by how much? In some cases, it may be better to cut your losses and roll that money into cans of paint instead. Certified books can’t be read and there are plenty of nice lower grades or reprints available for collecting. Thus, CGC books are for investing so if your particular book isn’t able to outperform plain old deck paint, especially during the 2012 to 2015 run when the market was surging, you may want to reconsider why you’re holding something that is ultimately eroding your wealth.

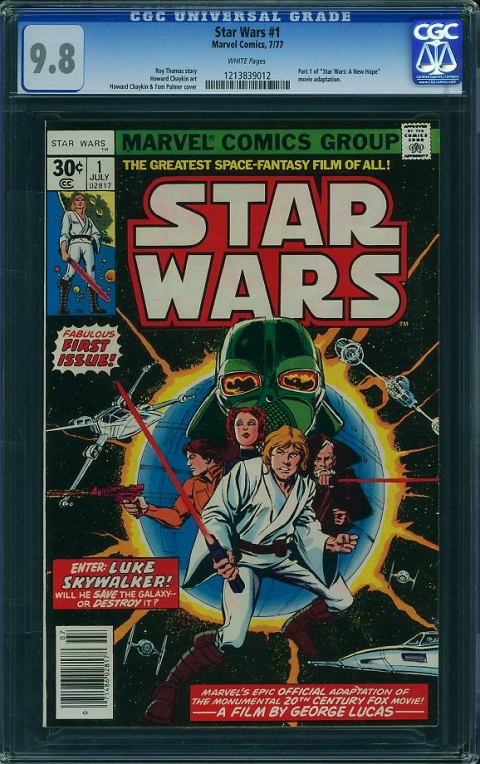

Okay… so, that’s my take on the current state of the market. Feel free to agree or disagree and share your thoughts or experiences. In the spirit of transparency, I also want to mention that I hold several copies of books mentioned in this write-up, with the exception of Amazing Fantasy #15, New 52 Batman #1, Hulk #1, Hulk #271, Star Wars #1 and Tales of Suspense #39. My comments are based on a bird’s eye view and nothing I’ve said is meant to be absolute, but rather, a general observation of the greater market. Finally, I am not seriously suggesting that people consider investing in cans of paint. It is a frame of reference that I’ve used to offer perspective.

Coming up… Maybe you noticed but I deliberately avoided talking about X-Men #94 because I’m planning on a separate write-up for this book. But before I do that, we’ll take a break from investing and go visit the indy pond and check out some artists on YouTube 😁

Salute!

Great post Charlie. I don’t agree with you on some fundamental points, but you are obviously a kindred spirit, thinking hard about the market, investment potential, and why there is investment potential in the first place.

My overall comment is: take a look at bitcoin, then take a look at Amazing Spider-Man #300 9.8 – then get concerned. I think there is understandable cross-linkage between these, which is not present for, say, the Mile High books that were recently auctioned off. I think the market for #300 is in large part composed of folks who are not hardcore comic collectors, but rather cultural speculators. My prediction is that a collapse in bitcoin will take down the super-hot modern age keys. I think it will have an impact on some bronze age books (e.g. Hulk #181) more than others (e.g. Green Lantern #76, which most of this younger speculators clearly don’t pay attention to). If bitcoin leads to a broader equity market sell-off, then you will see the ripple down through the older books.

I generally agree with you on movie fatigue. When you talk about Transformers you don’t show the chart for #1 9.8 – it looks like Bernie Madoff’s fund. This is a long-term play but my arguments are: not ridiculously plentiful; taps the non-superhero market; clearly has legs; is picking up a whole new generation of followers who will value the book similar to the first generation of toys.

Re super-expensive keys, believe it or not I made the same observation independently and I arrived at the same price point as you. I think people would rather own all the bronze age keys in 9.4 than one or two in 9.8, and you see this in the pricing. HOWEVER, I am more interested in Gold/Silver, and there I don’t think this holds. If there are two hundred 9.8s and four hundred 9.6s and 9.4s, this holds; if there is one 9.2 and the next book is a 8.0, it does not. There is also a related effect at the very low end – for many keys people will pay a substantial fraction of the 5.0 value for a 2.0. From an investment perspective this can open some opportunities, but the overhead gets in the way, because you have to hold many copies to invest the same number of dollars. As an individual I can’t handle this overhead.

One disagreement I have with you is Hulk #271. I think this is similar to Transformers #1 – not going anywhere fast, but if Disney handles the character the way that I expect them to, I am bullish for continued improvement. If this book had come out in 1990 I would not be interested, but 1982 is a different era. Based on the population I think a lot of the copies were ruined by being dumped into bins for years after the market collapse in the 90s. Also even at the time it was probably pretty unattractive, with the cover making it look like the Incredible Hulk was being replaced by a funny animal book.

Finally, in this overall vein I think the question of size and composition of the collecting/investing community is the key point into which I don’t have enough insight. What is clear is that there is “new” money coming in – if this were a dying community of old-timers, you wouldn’t see this kind of appreciation. How much of this is hot money, and how much is a true cultural shift, of people who will stomach the next downturn because they believe the books have reached a new level of cultural significance? I am optimistic that there are quite a few in the latter camp, but I don’t think many of these folks care about Amazing Spider-Man #300. I think the usual advice holds: invest in what you enjoy and understand, and diversify across asset classes (and in this class, across Ages, publishers, and genres).

Thanks Chris.

Re: bitcoin – I actually like bitcoins as a concept but I don’t know too much about it to make the correlation. But I like that you’re connecting the dots.

Re: Transformers – Here I was using the Transformers movie franchise as a series of bad movies that won’t seem to go away despite consistently harsh reviews and lack of respect. This, of course, is due to the Asian market and all the money that is flowing in from China specifically. The book itself is not on my radar but if the Hasbro movie universe ever gets underway… who knows?

Re: “Long term plays” – Be careful how long wait. In my opinion, if it can’t outperform house paint and double in the next 5 years, personally I would pass. I use to use gold as a reference, but some people took issue with this analogy so I’ve switch to cans of paint ^_^

Re: Hulk #271 – I highlighted Hulk #271 to illustrate the lack of influence from the recent GOTG movie. However, considering this was a dollar book not too long ago, even at the current price of about $450… it’s a HUGE WINNER, so credit where credit is due. As I stated in my write, the trick with these new books is not to buy at the top, but rather get in on the ground floor. But also, you can wait around and hope that Disney does something with RR, or you can cash out now and move that money into something more certain. Lots of other movies and characters out there.

Re: “New” money – Depends on what you mean by “new” money. People who never had any interest in comics aren’t going to sudden jump into comics because they enjoyed watching Wonder Woman. However, a successful movie does create awareness and I’ve met tons of people who got out of comics during the 90’s and have come back to it. They see the rising values and have re-entered the market as speculators, hoping and wishing that they had hung on to their old books. They have the knowledge, the connection and the motivation to get back in. 1990 was 27 years ago. If these people were 20 years old back then, today they’d be 47. Also depends on what you mean by “cultural significance”. Would you say comics are more or less significant than say… video games? movies? fashion? sports? the internet? art? cars? pre-fab homes or furniture? music? dance? fusion cuisine? religion? Comics are just what we are into.

“Invest in what you enjoy…” is great advice. Thanks again.